🔊 Play Benefits of Filing ITR on Time Introduction Filing your Income Tax Return (ITR) on time is not just a legal obligation but also a financially wise decision. By filing your ITR on time, you can avail yourself of various benefits and avoid unnecessary penalties. Let’s explore some of the key advantages of filing […]

Category: Income Tax return

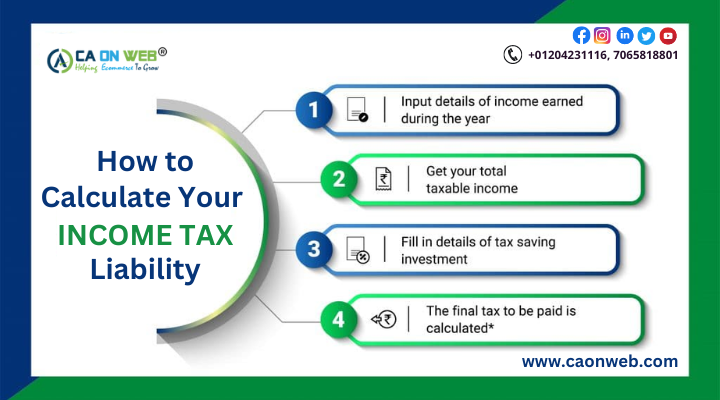

How to Calculate Your Income Tax Liability

🔊 Play In this blog, you will learn to calculate taxable income with Caonweb. Your overall tax obligation to the government is known as your income tax liability. The sum of income tax, surcharge, health and education cess is used to calculate it. Overview of Tax liability Tax liabilities are the sums of money that […]

Tax Consultation with a Tax Expert on a Phone call | CAonWeb

🔊 Play An online tax consultant is a specialist who works in a variety of fields, including international tax, transfer pricing, income tax counseling, and GST expert in Delhi. Tax Consultation involves in-depth subject knowledge and thorough analysis. With the help of Mr. Sanket Agrawal, you can get all importance of tax advice. He has helped many companies for maintaining tax […]

ALL ABOUT INCOME TAX RETURN FILING

🔊 Play A person keeps track of their earnings, expenses, tax deductions, investments, and taxes in an income tax return. Even if there is no income, a taxpayer must file an income tax return to report their annual earnings. This blog includes details on the electronic IT Return Filings, the steps involved, the benefits of doing […]

INCOME TAX RETURN FILING FY 2021-22 | AY 2022 -23

🔊 Play Since last year, the Income Tax Department has been quite vigilant in ensuring that Income tax return compliance in our country is as strengthen as much possible. The department’s goal is very clear, it wants you are complied with the laws for the time being in force with a move to operations online […]

INCOME TAX RETURN FILING IN INDIA

🔊 Play Individuals/HUFs/Associations/Businesses provide information about their income throughout the financial year and, if applicable, file their Income tax return electronically. Once the assessee’s final income is computed from all sources and subsequent income tax is computed, the process of Online Income tax filing begins. Different ITR Forms are required depending on the sources of […]

INCOME TAX RETURN FILING

🔊 Play Income tax is a tax forced by the Central Government on the income of a person. Every citizen is responsible for Income tax filing. The IT department examines these income declarations, and if any sum has been paid in error, the excess is refunded to the assessee’s bank account. To avoid penalties, all […]

Income Tax Fundamentals for the Assessment FY- 20-21

🔊 Play What is income according to the Income Tax Act? The term “income” has a very broad and inclusive meaning that is defined in Section 2(24) of the Income Tax Act; we will try to understand it broadly without going into too much detail. Income from Salary: This is the amount you receive from your employer […]

6 BENEFITS OF FILING INCOME TAX RETURN

🔊 Play The rules & regulations pertaining to Income tax return filing in India are enumerated in the Income tax act, 1961. These rules are to be followed by every registered taxpayer who possesses a valid PAN card and files ITR in a financial year. ITR must be filed in a prescribed format and should […]

Highlights of Budget 2020

🔊 Play A. Tax for individuals: A new tax regime, a person can move to a new tax slab structure which has 5 tax slabs however he cannot take any tax exemptions. The new tax slab structure has lower marginal tax rates for income up to Rs 15 lakh, when compared to the tax slab structure […]