Dear Promoter(s)/ Director(s) of the company,

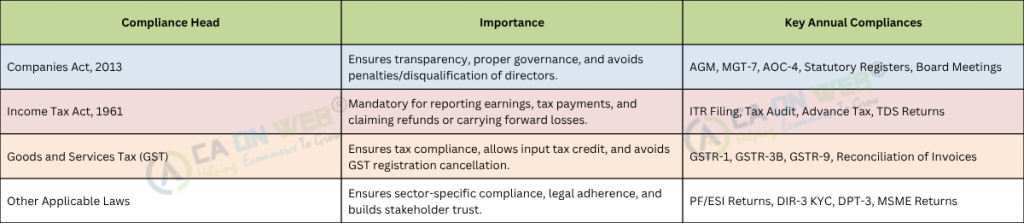

A Private Limited Company in India must comply annually with various statutory requirements under the Companies Act, Income Tax Act, and GST laws to ensure legal and financial discipline.

Under the Companies Act, 2013, key filings include the Annual Return (MGT-7), Financial Statements (AOC-4), auditor appointments (ADT-1), and director KYC (DIR-3 KYC), all within prescribed timelines post-AGM.

As per the Income Tax Act, the company must file its Income Tax Return (ITR-6), pay advance tax in instalments if applicable, conduct tax audits when thresholds are crossed, and submit quarterly TDS returns.

Under GST law, if registered, the company must file monthly or quarterly GSTR-1 and GSTR-3B, and the annual return GSTR-9, with GSTR-9C in case of high turnover.

Additionally, other compliances like PF/ESI returns, MSME disclosures, and

DPT-3 for loans may apply based on the company’s structure and operations.

Why is Annual Compliance for Private Limited Company is Important in India?

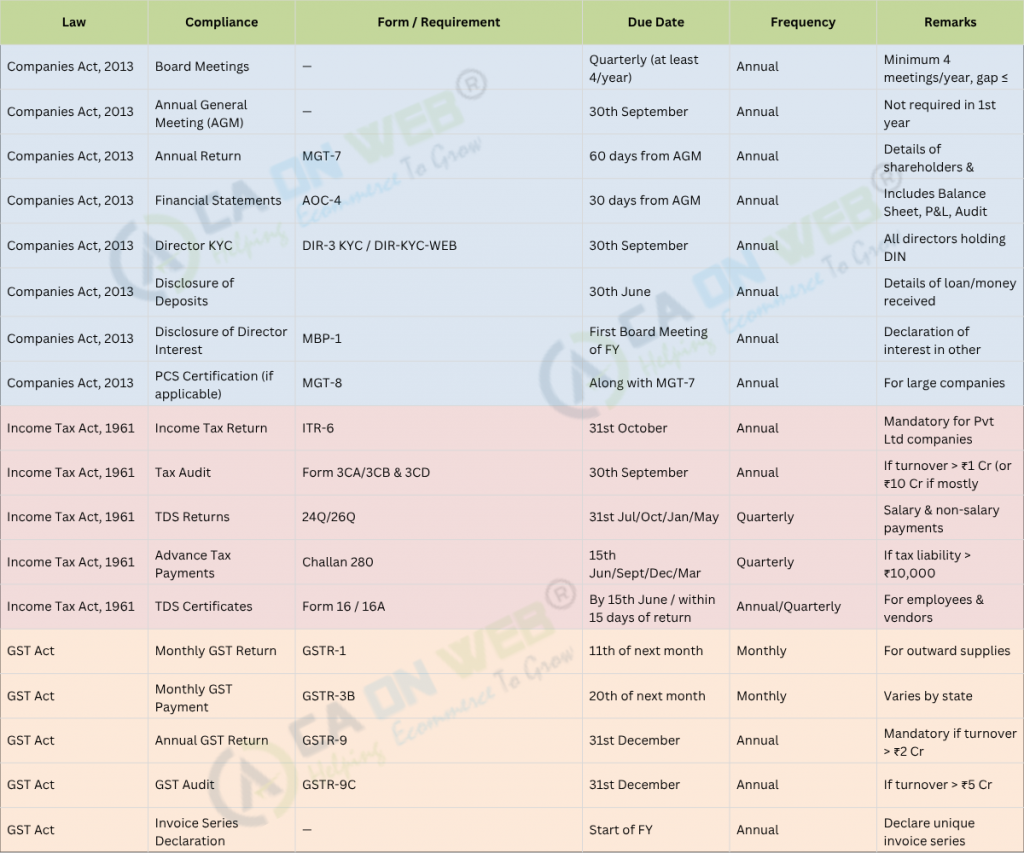

📌 Key Annual Compliance Due Dates (FY 2024-25)

Here’s a comprehensive summary of Annual Compliance for a Private Limited Company (Pvt Ltd) in India as per the Companies Act, Income Tax Act, and GST laws — ideal for tracking and filing.

Frequently Asked Questions (FAQs) on Annual Compliances of Private Limited Companies in India:

🔹 1. What are annual compliances for a private limited company?

Annual compliances refer to the mandatory filings, disclosures, and procedural requirements a private limited company must fulfill every financial year under various Indian laws like the Companies Act, Income Tax Act, GST, etc.

🔹 2. Why are annual compliances important?

They ensure legal standing, avoid penalties, promote transparency, and build investor and regulatory trust. Non-compliance can lead to fines, disqualification of directors, or even striking off the company.

🔹 3. What are the key annual compliances under the Companies Act, 2013?

• Filing Annual Return (MGT-7)

• Filing Financial Statements (AOC-4)

• Holding AGM (Annual General Meeting)

• Maintenance of Statutory Registers

• Conducting Board Meetings

🔹 4. What are the annual compliances under the Income Tax Act?

• Filing Income Tax Return (ITR-6)

• Conducting Tax Audit (if applicable)

• TDS Deduction & Return Filing

• Advance Tax payments

🔹 5. What are the GST compliances for a private company?

• Monthly/quarterly GSTR-1 & GSTR-3B filings

• Filing Annual Return (GSTR-9)

• Reconciliation of ITC (Input Tax Credit)

🔹 6. Are there any penalties for non-compliance?

Yes, penalties can range from ₹50 per day for late MCA filings to ₹1 lakh or more depending on the default. Directors can also be disqualified or prosecuted.

🔹 7. Is an audit mandatory every year?

Yes, a statutory audit is mandatory for every private limited company, regardless of turnover. If turnover crosses specific thresholds, a tax audit may also be applicable.

🔹 8. What if a company has no transactions during the year?

Even a dormant or inactive company must file annual returns and financials. There are no exemptions unless the company is officially struck off or converted.

🔹 9. Who is responsible for ensuring compliance?

The Board of Directors holds the ultimate responsibility. However, companies often appoint Chartered Accountants or Company Secretaries to manage compliance.

🔹 10. Can compliances be done online?

Yes, most filings like MCA forms, ITR, and GST returns are submitted online through their respective portals.

How can “CA On Web’’ help –

“CA On Web Private Limited” provides you the one stop solution to all your company compliances whether related to Taxation, MCA, GST or any other department. Don’t miss the opportunity to grab the best services at the best prices by highly qualified professionals.

At CAONWEB, our team of expert Chartered Accountants and Compliance Managers can help you:

- Track due dates

- Prepare and file all necessary forms

- Avoid penalties with timely reminders

- Provide expert guidance for hassle-free compliance

- 📞 Need Help With Compliance?

Contact us today at www.caonweb.com or call +91-7065818801

- Stay compliant, stay confident. Let us handle the paperwork while you focus on growing your business.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.