In this blog, you will learn to calculate taxable income with Caonweb. Your overall tax obligation to the government is known as your income tax liability. The sum of income tax, surcharge, health and education cess is used to calculate it.

Overview of Tax liability

Tax liabilities are the sums of money that a business or person owes to the municipal, state, and federal governments in the form of taxes. It is imperative for people to pay taxes on any income they get or sales they make as a business. Businesses pay different amounts of taxes depending on their nature, whereas individuals pay different amounts depending on their income level.

The sums of money that a company or individual owes to the local, state, and federal governments in the form of taxes are known as tax obligations. It is necessary for people to pay taxes on all their earnings and business sales. Depending on their nature, businesses pay varying amounts in taxes, and people pay different amounts depending on their income level.

All year long, businesses pay taxes to the government. Depending on several variables, including their nature, volume of sales or income, and tax bracket, various firms have different tax obligations. For instance, C companies only pay corporate tax; other business structures, such as partnerships and sole proprietorships, pay individual rates of tax. Accountants compute each of these elements and base their estimations of payments on the results.

- Business tax liability

- Payroll tax liability

- Capital gains tax liability.

- Sales tax liability

- Self-employment tax liability

What exactly is an income tax return calculator?

An income tax calculator is a tool you can use online to determine the taxes you owe based on your income following the release of the Union Budget. A specific percentage of your net annual income must be paid in income tax depending on the taxable income category you belong under.

Our tax calculator makes the computation of income tax returns very simple. Our income tax calculator, which has been updated in accordance with the most recent income tax e-filing rates and tax laws, assures that you will obtain a precise estimation of the tax due.

With the assistance of an online income tax calculator, individuals may accurately determine their total tax liability. Caonweb, expert Mr. Sanket Agrawal is helping many businesses to manage their tax liabilities and calculate taxable income. In order to determine your tax liability under the old or new income tax e filing system, the income tax calculator takes into account variables including your age, income, spending, allowable tax deductions, and current investments. Ca Near Me

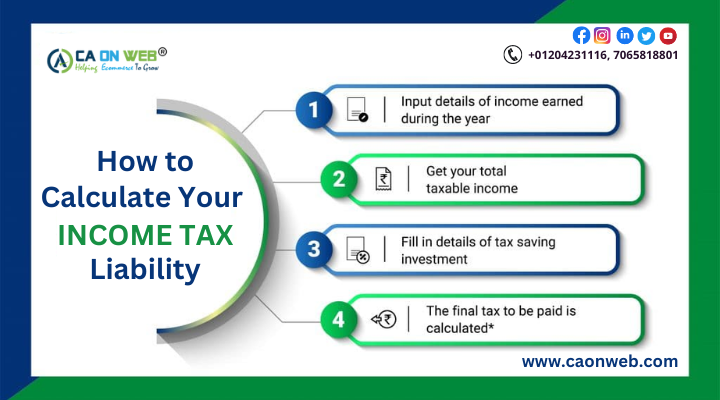

Guide to calculating taxable income

The first income tax payment a citizen makes, marks a significant moment in their life. Yet, a novice may find the procedure to be tiresome and burdensome, and even some of the phrases may be confusing. There is, however, no cause for concern. Here is a list of fundamental income tax e-filing knowledge for newcomers that can assist you in comprehending the tax ramifications of your revenue.

It’s simple to figure out your income tax return liability. Just use the basic formula:

The sum of all Your Earnings = Total Gross Income – Deductions = Taxable Income

According to the Income Tax Act of 1961, there are five types of income.

Earnings from a salary

Obtain Form 16 & calculate your gross compensation, add any allowances (HRA, TA, DA, medical, etc.) and reimbursement, along with any bonuses. Subtract the appropriate HRA, LTA, and medical expense exemption amounts, if any. Remember that you may deduct up to 50,000 in standard deductions from your yearly salary.

Income from a residential property

Determine your property’s net income, mostly the rental income, first. Also, a self-occupied home’s profit must be calculated (although, it will generally be a nil or negative value). Deduction U/S 24 is another option for lowering taxable income.

- According to Section 24(a), a deduction of 30% of NAV (Net Annual Value) must be possible.

- Also, under Section 24(b), interest on borrowed capital is deductible.

Under section 80c, you may deduct up to Rs 1,50,000 in principal payments from your taxable income each year. Both privately owned homes and rented units are covered by this. Stamp duty and registration fees are also included.

Gains from capital investments

Any income you receive through the sale of a capital asset, such as stocks, bonds, or real estate, is considered income from capital gains. You could have either short-term or long-term capital gains. Calculating both your short-term and long-term capital gains is the third stage. In addition, if applicable, claim any deductions allowed by Sections 54, 54G, and 54EC. After this, your income from capital gains is what is left.

Revenue from business and profession

Use the net profit from the previous fiscal year as the basic amount to determine your company’s taxable income. To determine the taxable value of your net profit, subtract all the deductions authorized under the IT Act and add back all the expenditures that are not permitted.

Other sources of income

This category includes income from lottery winnings, horse races, fixed deposit or savings account interest, mutual fund dividends, and any revenue from gifts, family pensions, or lottery winnings. To calculate your net income, add them all up and take any deductions into account.

Steps to calculate taxable income in detail.

Step 1: Gather all relevant documents to calculate taxable income.

First, you’ll need to gather all the documents related to your income for the year. This includes your W-2 form from your employer, 1099 forms if you’re self-employed or received income from other sources, receipts for any expenses you plan to deduct from your income, and any other relevant financial documents.

Step 2: Determine your total income.

Your total income is the sum of all the money you’ve earned during the year, including wages, tips, bonuses, and any other income. This should be listed on your W-2 form if you’re an employee, or on your 1099 forms if you’re self-employed. If you have multiple sources of income, add them all up to get your total income for the year.

Step 3: Determine your deductions.

Deductions are expenses that you can subtract from your total income to reduce your taxable income. Some common deductions include mortgage interest, charitable donations, and state and local taxes. To determine your deductions, you’ll need to add up all your qualifying expenses and subtract them from your total income. Keep in mind that there are limits to some deductions, so be sure to check the IRS guidelines for each deduction.

Step 4: Calculate your taxable income.

To calculate your taxable income, subtract your deductions from your total income. This will give you the amount of income that is subject to taxation.

Step 5: Determine your tax bracket.

Once you know your taxable income, you can determine your tax bracket using the IRS tax tables. Each tax bracket has a range of income levels and a corresponding tax rate. Find the bracket that your taxable income falls into and look up the tax rate for that bracket. Multiply your taxable income by the tax rate to determine your total tax liability.

Step 6: Subtract any tax credits.

Tax credits are amounts that can be subtracted from your tax liability, reducing the amount of taxes you owe. The child tax credit achieved income tax credit, and the American opportunity tax credit is a few examples of common tax credits. Subtract any tax credits that apply to you from your total tax liability to get your final tax bill.

Step 7: File your tax return

Once you’ve calculated your taxable income and determined your tax liability, you’re ready to file your tax return. Be sure to include all the relevant forms and documents and double-check your math to avoid errors. If you’re unsure about any aspect of your tax return, consider consulting with a tax professional for help.

How is it to calculate income tax? : Example

Calculating income tax returns can be a confusing task for many individuals, but with a little bit of understanding and attention to detail, it can be broken down into easy steps. Here is an example of how to calculate income tax for an individual who earns a salary of Rs.50,000, is single, and has no dependents.

Step 1: Determine Taxable Income

The first step in ITR filing is to determine the taxable income. To do this, take the gross income and subtract any deductions or exemptions. In this example, let’s say that the taxpayer claims the standard deduction of Rs.12,400. Therefore, the taxable income is Rs.50,000 – Rs.12,400 = Rs.37,600.

Step 2: Determine the Tax Bracket

After finding the taxable income, the next step is to determine the tax bracket under which it falls. The US tax system is set up in a progressive manner, so different levels of income are taxed at different rates. For the current tax year (2021), the tax rates and income brackets are as follows:

- 10% on income up to Rs.9,950

- 12% on income between Rs.9,951 and Rs.40,525

- 22% on income betweenRs.40,526 and Rs.86,375

- 24% on income between Rs.86,376 and Rs.164,925

- 32% on income between Rs.164,926 and Rs.209,425

- 35% on income between Rs.209,426 and Rs.523,600

- 37% on income over Rs.523,600

Since the taxpayer has a taxable income of Rs.37,600, they fall into the 12% tax bracket.

Step 3: Calculate Income Tax With the tax bracket determined,

calculating the income tax becomes straightforward. To figure out how much tax the taxpayer owes, take their taxable income (Rs.37,600) and multiply it by the tax rate in their tax bracket (12%). This gives:

Rs.37,600 x 12% = Rs.4,512

This figure represents the total amount of income tax that the taxpayer owes.

Step 4: Adjust for Credits and Payments

Finally, after calculating the income tax owed, there may be adjustments made for any credits or payments made throughout the year. The most common types of credits include earned income tax credits, child tax credits, and educational credits. If the taxpayer qualifies for any of these credits, they can reduce the amount of income tax owed. Additionally, any payments made throughout the year (such as through withholding on paychecks) can be subtracted from the amount owed to arrive at the final income tax owed.

In summary, calculating income tax requires determining the taxable income, determining the tax bracket, calculating the income tax owed, and adjusting for any credits or payments made. For new tax regime updates and calculate taxable income connect with Caonweb.

Frequently Asked Questions

Q.) What sets this online income tax calculator apart from other calculators?

Using information from your payslip, the income tax calculator computes income tax. Taxable Income is not excluded from the calculations.

Q.) Is it possible to select either the Old Regime or the New Regime?

Both Old Regime and New Regime income tax calculations are done automatically using the calculator. Furthermore, the calculator suggests the regimen that will work best for you.

Q.) What percentage of my salary income should I pay in income tax?

Simply enter information from your payslip into the income tax calculator to calculate tax, and you’ll know exactly how much you need to pay.

Q.) More tax is being withheld by my employer than the calculator indicates. What ought I do?

Print the findings of the tax calculation and give them to your employer.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.