🔊 Play Introduction: Filing income tax returns (ITR) can be daunting, but with the right guidance, it becomes a breeze. At Caonweb, under the expert guidance of CA Sakshi Agarwal, we understand the nuances of Income Tax Return Filing. Here are some crucial things to keep in mind. 1. Understand Your Income Sources: Identify all […]

Category: ITR Filing

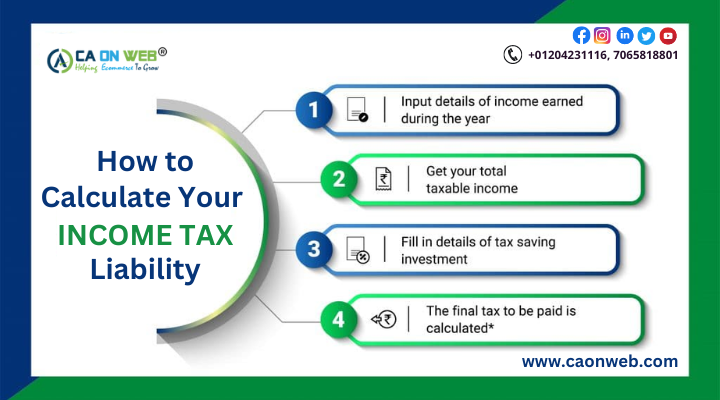

How to Calculate Your Income Tax Liability

🔊 Play In this blog, you will learn to calculate taxable income with Caonweb. Your overall tax obligation to the government is known as your income tax liability. The sum of income tax, surcharge, health and education cess is used to calculate it. Overview of Tax liability Tax liabilities are the sums of money that […]