Private Limited Company is the most popular and prominent type of corporate legal entity in India. The Ministry of Corporate Affairs, the Companies Act, 2013 and the Companies Incorporation Rules, 2014 regulate private limited company registration. A least two shareholders and two directors are required to register a private limited company. While a corporate legal entity can only be a shareholder, a natural person can be both a shareholder and the director.

Besides, foreign citizens, foreign corporate entities or NRIs may be directors or shareholders with Foreign Direct Investment of a company making it the preferred entity option for international promoters.

Are you thinking of setting up your business in Delhi? Do you want to know the process involved in private limited company registration in Delhi?

CAONWEB can help you with private limited company registration in Delhi.

Pre-requisites for Private Limited Company Registration in Delhi

- 2 Directors

- 2 Shareholder

- Registered Office Address (Residential/ Non-Residential)

Document required for private limited company registration in Delhi

The applicant must mandatorily submit the following documents along with the identity card and address proof:

- Memorandum of Association

- Article of Association

- Copy of PAN Card

- Copy of Aadhar Card

- Firm Address Proof like Electricity Bill or Telephone Bill or anything similar that has full name and address of the firm in legible language. (not more than two months old)

- Rent agreement or Electricity Bill if the business place is taken on rent duly attached with No objection Certificate (NOC) issued by the owner.

Process for Private Limited Company Registration in Delhi

- The first step is to apply for Digital Signature Certificate (DSC) and Director Identification Number (DIN)

- Then apply for approval of the name with Registrar of Companies (ROC), Delhi

- The third step is to apply for Registration in INC-32 forms

- The last step is to obtain a Registration Certificate.

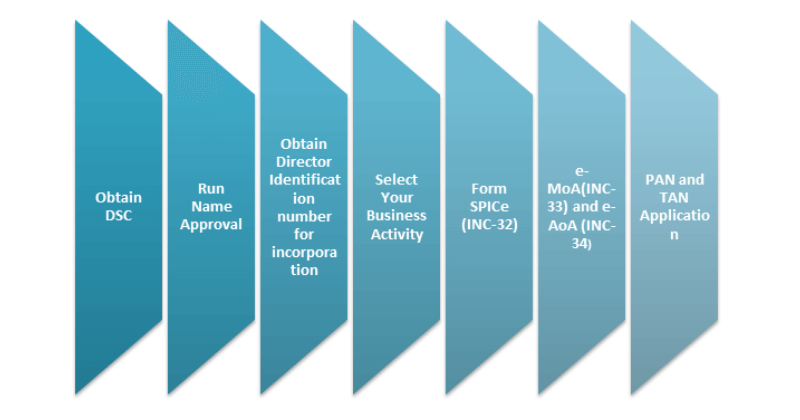

Following are the steps involved in registering a private limited company:

1. Obtain DSC

Since we are taking an online route to register a private limited company, Digital Signature is mandatorily required. It is mandatory for all the subscribers and witnesses in the memorandum and article of association. You can obtain Digital Signature Certificate either online or offline from government recognized certifying agencies. There are two category of DSC available, i.e. Class 2 and Class 3. Under Class 2, your identity will be verified against a pre verified database, whereas under class 3, you need to be present in person before the registering authority.

Related Blog – All you need to know about Company Registration as a startup

2. Run Name Approval

There are two options to get name approval

- Incorporate a company via Reserve Unique Name (RUN) form.

- Apply for the proposed name through SPICe(INC-32)

Option 1:

In an attempt to ease the registration procedure, RUN web service has been introduced by Ministry of Corporate Affairs. While filling RUN form, be extremely careful as it gives you only one chance for applying and in case of rejection of name (based on valid grounds) there is no second chance available. In this case you have to re-file another RUN form by again paying the prescribed fees.

To apply for a name using RUN web from, the applicant must first create a MCA account. The account is free of cost. After creating and logging into the MCA account, the registrant can choose “Private Limited” as the type of company to be registered. He further needs to provide one name choice and check against the database of MCA to check the availability.

It is important to note that MCA Run System only check for identical company names. However the Company Incorporation Rules, 2014 says a company cannot be registered with an identical name. Hence even if the MCA database shows the availability of name, it does not guarantee approval.

Option 2:

However, with effect from March 23, 2018, Ministry has decided to permit two proposed Names and one re-submission (RSUB) while reserving Unique Names for the Companies.

You must think carefully before adopting a name because any name that violates the rules will not be allowed to use. There’s a list of undesirable names that can’t be used.

If it is identical with or too closely resembles the following, a suggested name will be considered as undesirable.

- Existing company names and LLPs or names approved by the Company Registrar and LLPs.

- A registered trademark or trademark for which others have applied for registration and used it or owned it.

- Names are given under and in violation of the Emblems and Names Act, 1950.

- Foul words or phrases. Words or expressions used as a derogatory term and offensive to a group of people.

- Names with “British India” words.

3. Obtain Director Identification Number for Incorporation

All individuals who are proposed to be the director of the company should have a valid Director Identification Number. The person should apply for DIN only through the SPICE from. All the details should be filled in the SPICE form along with their PAN or Passport details. On incorporation of the company, DIN will be allocated to the person who has duly applied for DIN.

If a person already has a DIN and incorporating a new company, SPICE form must still be used and DIN can be entered wherever applicable.

4. Selecting Your Business Activity

Next, you should choose the operation your Private Limited Company will engage in. You can decide from any of the alternatives that you have been given. And if you cannot find the correct option for your operations, you can select the’ other’ option. It is requested to appoint a professional so that he/she can help you with drafting memorandum and article of association.

5. Form SPICe (INC-32)

Ministry of Corporate Affairs has introduced Form SPICe (INC-32) to simply the process for incorporating and registering a company online. Prior to the introduction of SPICe form, a company is required to file several documents like DIR-3, DIR-12, INC-1, INC-7, INC-22 for different registration requirements. Now all these forms have been merged together in a simplified way.

A professional’s digital signature is mandated to file the INC-32 form. The professional must certify the correctness of all the information provided in the form. The professional can be a Chartered Accountant, Company Secretary, Cost Accountant or advocate.

6. e-MoA(INC-33) and e-AoA (INC-34)

The intention behind introducing e-MoA and e-AoA is to simply the company registration process in India. e-MoA and e-AoA stands for electronic Memorandum of Association and electronic Articles of Association respectively.

The forms need to be filed online on MCA portal and they are linked with SPICe (INC-32). Both of these forms must be mandatorily filed by the subscribers of the Memorandum and Article of associations.

Get Import Export Code Online on lowest cost.

7. PAN and TAN Application

You can apply for the PAN and TAN of the company through the single SPICe form by using forms 49A for PAN and 49B for TAN. After submitting the SPICe form, the system will auto-generate PAN and TAN form. All you need to do is download it, attach electronic signatures and upload both forms to the MCA portal.

If all the information in the form is properly filled in along with the necessary documents, MCA will approve the registration and a CIN (Corporate Identity Number) will be given. This CIN can also be tracked on the MCA portal online.

Ministry of Corporate Affairs has significantly made the registration process a lot more simple and easier in an effort to spur new start-ups.

Frequently Asked Questions

1. What is the fee for Incorporation?

The MCA has announced zero fees for incorporation up to 10 lakh of an authorised capital in an attempt to simplify the company incorporation process and encourage new start-ups. Hence, Businesspeople would be able to save a thousand rupees as an incorporation fee. Notwithstanding the announcement of zero fees for the SPICE form, eMOA and eAOA–stamp duties would still be valid for incorporation as before depending on the state of incorporation.

2. What are the changes made in the registration process in 2017 and 2018?

By reducing the forms for name approval, DIN application and incorporation, the MCA has accomplished substantial process decrease while enhancing the ease of using SPICe form.

A significant drawback in using the SPICe form earlier was that Entrepreneurs or Professionals were unable to acquire previous approval of the name. In the event of refusal of name while using SPICe Form, they were compelled to redo incorporation paperwork. But now, MCA has streamlined the name approval process and made it optional by implementing a web-based method for name authorization called RUN.

3. Can a proposed director of a new company apply for DIN through Form DIR-3?

As per the company registration process 2018, DIR-3 form can only be used for adding a director by existing companies. Hence, due care must be taken by the professionals to ensure that DIN, through DIN-3 is not obtained for a proposed director of a new company.

4. What are the documents required for filing SPICe (INC-32)

The following documents are required for filing SPICe (INC-32):

- If the Director or Subscriber is an Indian National

- PAN Card

- Address Proof: It can be Passport, Voter ID Card (Election Card), AADHAR Card, Electricity Bill, Telephone Bill, Ration Card or Driving License.

- Residential Proof: It can be Bank Statement, Electricity Bill, Telephone Bill or Mobile Bill.

- If the Director or Subscriber is a Foreign National

- Passport

- Address Proof: It can be Driving License, Residence Card, Bank Statement or Government issued form of identity containing address.

- Residential Proof: It can be Bank Statement, Electricity Bill, Telephone Bill or Mobile Bill.

5. What is the time required to register a company?

Since nowadays a company registration has become a fast track process, it takes lesser time to register a company online as compared with the old process.

You can read more such blogs on our official website CAONWEB. Click here to visit now.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.