Grant of Unique Identification Number(UIN)

- Any specialized agency of the United Nations Organization or

- any Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947),

- Consulate of

- Embassy of foreign countries ;

- Any other person or classes of person notified by the Commissioner shall obtain Unique Identification Number

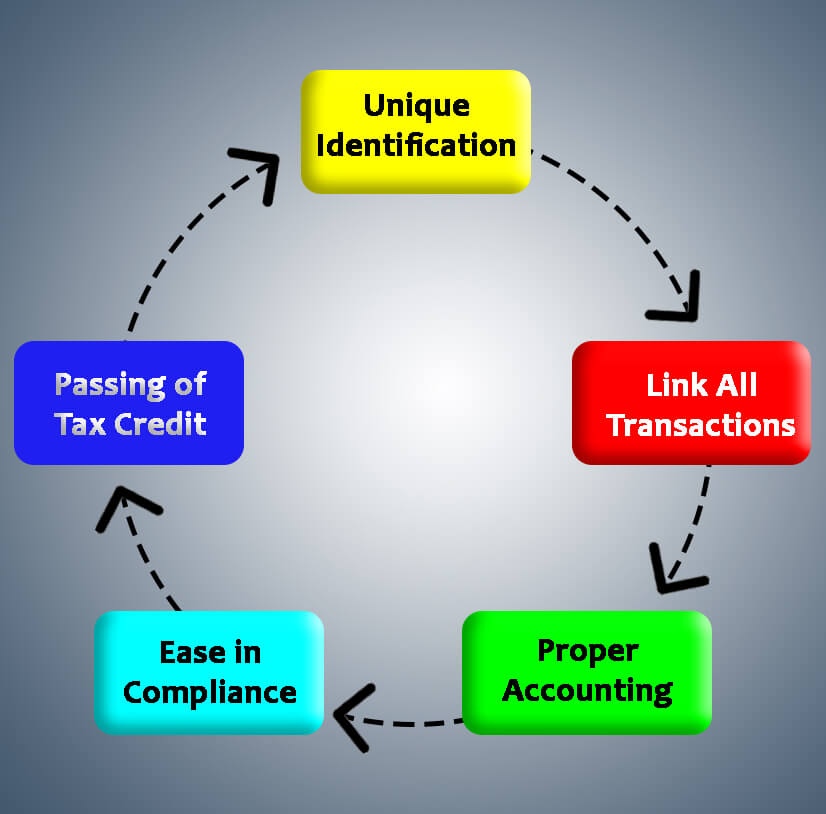

The structure of the said ID would be uniform across the States in conformity with GSTIN structure and the same will be common for the Centre and the States.

This UIN required for claiming a refund of taxes paid by them and for any other purpose as may be prescribed in the GST Rules.

Responsibility of the taxable person supplying to UN bodies

The taxable supplier supplying to these organizations is expected to

- mention the UIN on the invoices and treat such supplies as supplies to another registered person (B2B) and

- the invoices of the same will be uploaded by the supplier.

Registration for Govt. organization

A unique identification number (ID) would be given by the respective state tax authorities through GST portal to Government authorities / PSUs not making outwards supplies of GST goods (and thus not liable to obtain GST registration) but are making inter-state purchases.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.