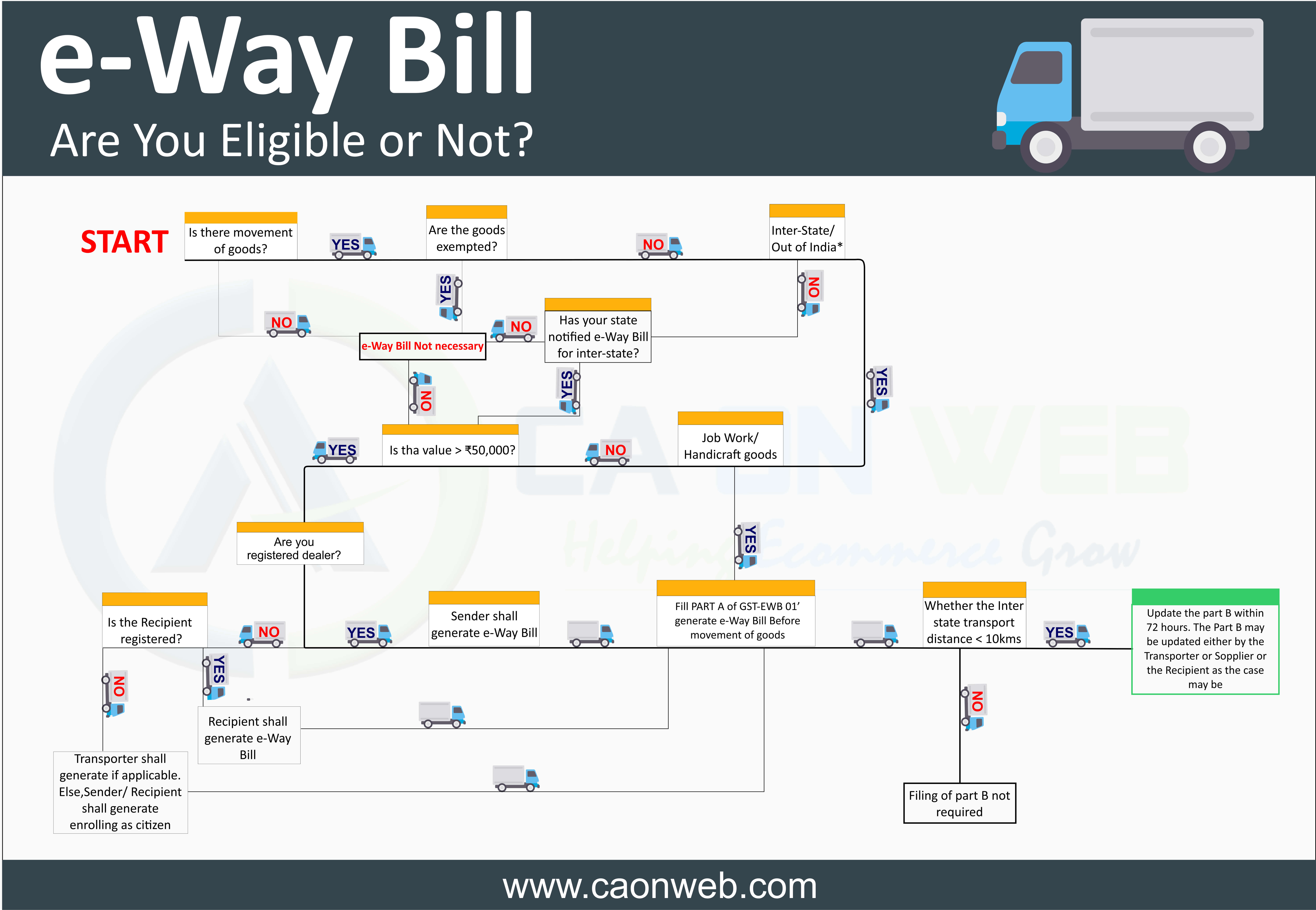

An electric waybill is required for movement of goods. For any movement of goods by a registered person for the value of more than Rs.50000 e-way bill is mandatory. The e-way bill can be generated on the Goods and Service Tax portal. This is required for interstate and intrastate both. Generation of the e-way bill is compulsory from 1st Feb 2018.

Who is required to generate E-way bill or when should an e-way bill issue?

- The registered person when there is the movement of goods

- In relation to the supply like normal sale activity

- In relation to the return of sale, transfer from one branch to another

- Inward supply from an unregistered person. Unregistered Person making movement of goods

Note: When supply is made by an unregistered person to a registered person, the party receiving goods will have to fulfill the compliances. Transporter also needs to generate the e-way bill if the supplier has not generated the e-way bill.

When is e-way bill not required?

- Transporting goods within the same state for distance less than10 km from the place of business of transporter to the person receiving goods or from the place of a supplier to the place of the transporter.

- The mode of transportation is the non-motor vehicle

- Goods transported from port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

- Transport of specified goods

Documents required for an e-way bill

- Invoice or Bill of Supply or challan relating to the consignment of goods.

- Transportation by road – Transporter ID or Transporter Vehicle number.

- Transportation by rail, by air, or by ship – Transporter ID, Transport document number, and date on the document.

The validity of the e-way bill

The date is computed from the time of generation of the e-way bill.

| Distance | Validity of EWB |

| Less Than 100 Km | 1 Day |

| For every additional 100 Kms or for part thereof | additional 1 Day |

Cancellation of the e-way bill

E-way bill can be canceled if goods are either not transported or goods transported are not as per the details filled up in the e-way bill.

However e-way bill cannot be canceled if it has been verified in transit.

States notifying the e-way bill

States that have notified e-Way bill for mandatory inter-state transport of goods:

- Karnataka

- Uttarakhand

- Rajasthan

- Kerala

Rest of the 25 States and 7 Union territories have joined the e-Way Bill league on trial basis till 31st Jan 2018.

Starting from 1st Feb 2018, all the registered suppliers or the transporters or recipients as the case may be belonging to these 25 States and 7 Union territories are required to compulsorily generate e-Way Bill for Inter-State movement of goods.

13 States have agreed to implement e-Way Bills for Intra-State movement of Goods with effect from 1st February 2018. These are:

- Andhra Pradesh

- Arunachal Pradesh

- Bihar

- Haryana

- Jharkhand

- Karnataka

- Kerala

- Puducherry(UT)

- Sikkim

- Tamil Nadu

- Telangana

- Uttar Pradesh and

- Uttarakhand

For any queries relating to goods and service tax, new GST registration process in India, GST filing in India and, other GST services you can contact professionals through our online platform of CAONWEB. Here, you can find professionals having expertise in providing GST services to various clients.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.