🔊 Play In the bustling financial landscape of Delhi NCR, finding the right Chartered Accountant can be a crucial decision for businesses and individuals alike. Here, we present a comprehensive guide to the Best CA Firms in Delhi, ensuring you make an informed choice for your financial needs. Introduction: Delhi, being the economic hub it […]

Patent Registration in India – Guide by Caonweb’s Expert

🔊 Play Introduction: Are you an innovator or business owner seeking protection for your groundbreaking ideas? Look no further! Caonweb, with the expertise of CA Sakshi Jain, is your trusted partner in navigating the intricacies of Patent Registration in India. 1. What is Patent Registration? When an invention is registered as a patent, the owner […]

COMPANIES FRESH START SCHEME, 2020 (CFSS-2020)

🔊 Play The Central Government in the exercise of powers have introduced the COMPANIES FRESH START SCHEME, 2020 (CFSS-2020), It shall facilitate the companies registered in India to make a fresh start. This scheme aims at providing a one-time opportunity to enable defaulting companies to complete their pending compliances by filing necessary documents in the Ministry […]

BUSINESS REGISTRATION, LICENSE & COMPLIANCE FOR EXPORTERS IN INDIA

🔊 Play Seamless Exporting Starts Here Owning a business & hoping to expand and sell your products overseas through major online portals like Alibaba and Amazon, exporters in India must ensure they are fully compliant with legal and regulatory requirements. Proper registration, licensing, and adherence to compliance standards are essential steps to establish a credible […]

Compliances under various laws for Private Limited Company engaged in Exports

🔊 Play A Private Limited Company in India that is engaged in exports must comply with various legal, regulatory, and tax-related requirements under multiple laws. Below is a comprehensive list of compliances to be followed, categorized under different heads BRIEF SUMMARY Area Relevant Law Key Documents Corporate Companies Act AOC-4, MGT-7, AGM Resolutions Tax Income […]

Annual Compliances for Private Limited Companies

🔊 Play Dear Promoter(s)/ Director(s) of the company, A Private Limited Company in India must comply annually with various statutory requirements under the Companies Act, Income Tax Act, and GST laws to ensure legal and financial discipline. Under the Companies Act, 2013, key filings include the Annual Return (MGT-7), Financial Statements (AOC-4), auditor appointments (ADT-1), […]

Income Tax Online Filing for FY 2024–25

🔊 Play Caonweb – Expert CA Sakshi Agarwal Filing your income tax online need not be confusing. At Caonweb, guided by Income Tax Return Filing specialist CA Sakshi Agarwal, we simplify the income tax filing process for all over India. 1. What is Income Tax Return Filing? Industry expert CA Sakshi Agarwal reviews: “This section […]

📌 What is Director KYC (DIR-3 KYC)?

🔊 Play Director KYC is an annual compliance for all directors holding a Director Identification Number (DIN). It ensures the Ministry of Corporate Affairs (MCA) has updated personal details of directors. 🧾 Who Needs to File DIR-3 KYC? 🗓️ When is the Due Date? 📋 Types of DIR-3 KYC Forms 📑 Documents Required 💰 Penalty […]

GST ON YOUR FAVORITE SNACK, Pop Corn

🔊 Play UNPACKED AND UNLABELLED SALTED POPCORN The GST Council’s recent clarification on popcorn taxation has ignited a wave of online memes, with users analysing the complexities of tax rates for various types of popcorn. During its 55th meeting on Saturday, the GST Council clarified the tax structure for popcorn and announced that there would […]

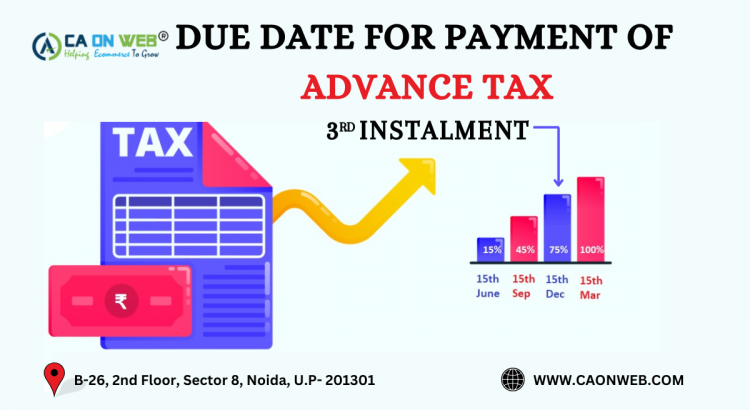

DUE DATE FOR PAYMENT OF ADVANCE TAX

🔊 Play Taxpayers are required to settle 75% of their advance tax obligation by December 15, 2024. Advance tax, commonly called income tax paid in advance for earnings within the same financial year, is an integral part of tax compliance. Often called ‘pay-as-you-earn’ tax, individuals and businesses with a tax liability of Rs 10,000 or […]

COMPLIANCE HEADACHES?

🔊 Play Are you an EU seller? Starting on December 13, 2024, all general products (non-food) must comply with the General Product Safety Regulation (GPSR). This means that all sellers without a physical presence in the EU must appoint a responsible person. Compliance is essential to ensure that your products remain available in the EU […]

WHY YOU NEED A DIRECTOR KYC

🔊 Play In today’s business world, compliance is key. One essential aspect of corporate compliance is Director KYC (Know Your Customer). It ensures that all directors of a company are verified, promoting transparency and trust within the business environment. But why exactly is Director KYC so crucial? Let’s dive in. What is Director KYC? Director […]