Taxpayers are required to settle 75% of their advance tax obligation by December 15, 2024.

Advance tax, commonly called income tax paid in advance for earnings within the same financial year, is an integral part of tax compliance. Often called ‘pay-as-you-earn’ tax, individuals and businesses with a tax liability of Rs 10,000 or more in a financial year must pay Advance TAX to comply with regulatory requirements. This requirement pertains to corporations, entrepreneurs, and salaried professionals who are expected to adhere to these rules.

Taxpayers must remain vigilant and ensure prompt payment of their advance tax obligations to avoid penalties or compliance issues.

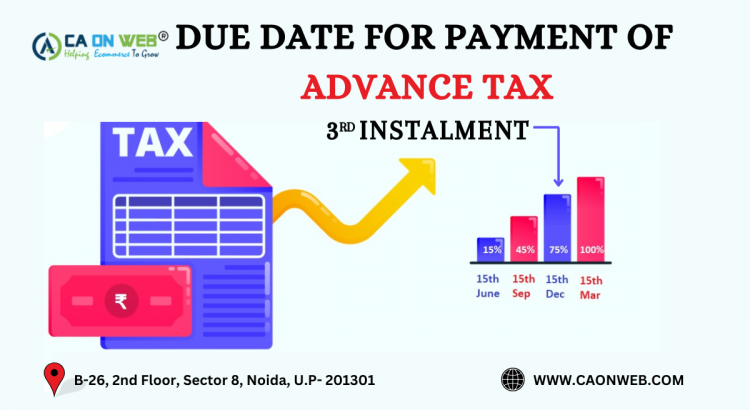

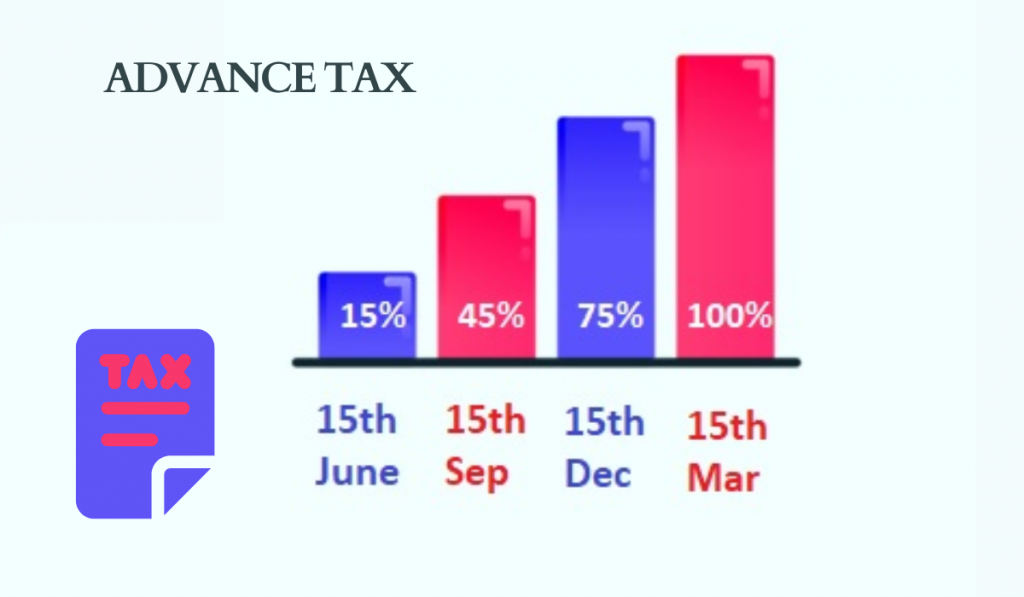

Quarterly payment

To meet this obligation, the advance tax must be paid in four instalments before the end of the financial year. The payment deadlines are June 15, September 15, December 15, and March 15. This year, the deadline for the third instalment of advance tax payment for the financial year 2024-25 is December 15.

📢Payment schedule

Deadline for advance tax payments:

| June 15, 2024: | Submit 15% of the advance tax liability. |

| September 15, 2024: | Submit 45% of the advance tax liability (minus any previous payments made). |

| December 15, 2024: | Submit 75% of the advance tax liability (minus any previous payments made). |

| March 15, 2025: | Submit 100% of the advance tax liability (minus any previous payments made). |

Tax payment

Employers deduct taxes from salaried individuals’ salaries before disbursing the payments at the end of the month. However, other sources of income—such as interest from deposits, capital gains from selling shares, and mutual fund units—are not accounted for in this process. It is essential to consider these additional sources of income when calculating advance tax liability.

The rules vary for self-employed individuals who have opted for the presumptive taxation scheme. While they are still required to pay advance tax, they can make a single payment in the last quarter of the financial year, specifically by March 15. This provision is designed to help small businesses manage the difficulties of accurately estimating their advance tax liability at the start of the financial year.

📢Deadline on Sunday

Taxpayers are uncertain about whether they can make their tax payment on December 16, 2024, since December 15 falls on a Sunday. According to the Income Tax circular, if the due date for advance tax payment falls on a public holiday, the following business day will be considered the final deadline for making the payment.

Taxpayers should be aware that the due date for the third instalment of advance tax for the financial year 2024-25 is December 15, 2024, which is a Sunday. Therefore, payments can be made by December 16, 2024.

However, it’s important to note that the due date for future instalments will remain December 15, if it does not fall on a weekend or public holiday,”

Taxpayers can connect with a Noida-based Chartered Accountant firm, CA on Web, their financial advisor, to ensure their advance tax is paid before the deadline.

📢Related Blog: Advance tax & TDS

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.