CONTENTS OF TOPIC

| S.No. | Particulars |

| 1 | Introduction |

| 2 | Requirements associated with Form 26QB |

| 3 | Steps to fill Form 26QB |

| Steps to Download Form 16 | |

| 4 | Illustration on successful filing of Form 26QB |

| 5 | FAQs |

| 6 | Conclusion |

| 7 | Expert Insights |

Introduction to 26QB

Under Section 194-IA of the Income Tax Act, 1961, when an individual purchases immovable property worth more than Rs. 50 lakh, they are required to deduct 1% TDS from the sale amount when making payment to the seller. The deducted TDS amount needs to be paid to the government by filing Form 26QB within 30 days from the end of the month in which the TDS deduction was initiated This form helps in reporting the TDS deducted to the Income Tax Department.

Requirements Associated with Form 26QB

Section 194-IA of the Income Tax Act 1961 establishes rules regarding the purchase and sale of immovable property, such as land and buildings.

- A buyer must deduct 1% TDS from the sale value of the immovable property at the time of the transaction.

- A buyer is not required to deduct TDS payment on the purchase of property if its cost is below Rs. 50 lakh.

- A buyer is not required to obtain a Tax Deduction Account Number (TAN) for collecting and paying TDS to the government. However, PAN details of both the buyer and the seller are necessary if TDS is deducted using Form 26QB.

- If the property’s payment is made in instalments, TDS is deducted in instalments on a pro-rata basis.

- After deducting and paying TDS, a buyer must issue a Form 16B (TDS certificate) to the seller within 15 days. If there are multiple buyers, TDS must be paid at similar rates by all of them.

- A buyer is not required to deduct TDS if the immovable property is classified as agricultural land.

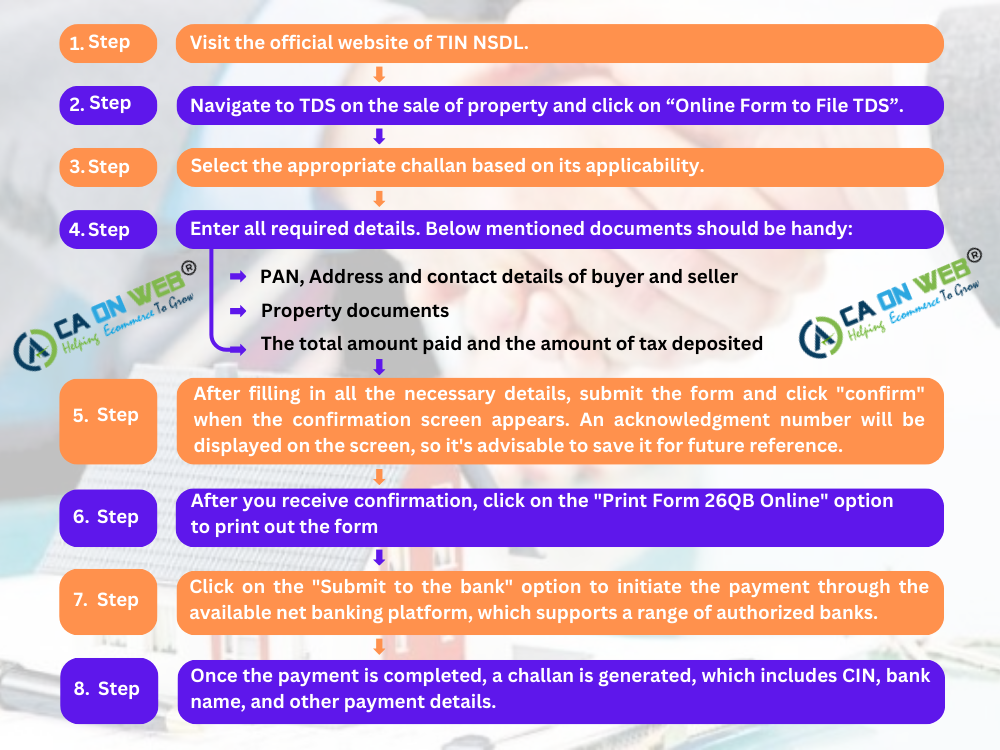

Steps to Fill Form 26QB Online

Buyers need to follow the steps below to make TDS payments online:

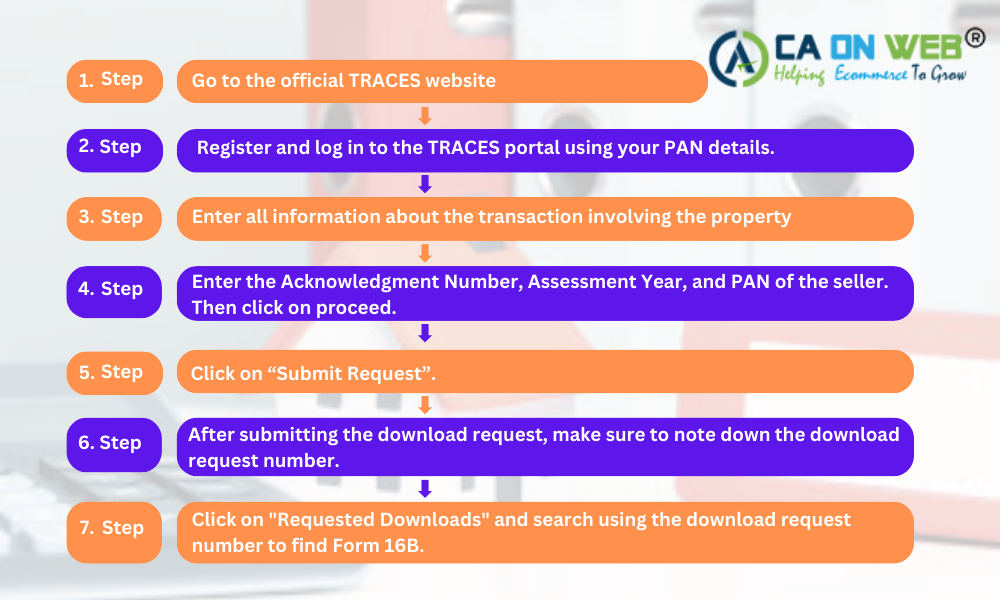

After deduction of TDS, the buyer must issue Form 16B to the seller within 15 days, representing the TDS amount paid to the government.

Form 16B can be downloaded 5 days after submitting Form 26QB by following these steps:

Illustration on Successful Filing of Form 26QB

Consider a case where Mr. A purchased a property for ₹82 lakhs. He followed the above steps to file Form 26QB, paid the TDS on time, and generated Form 16B. This hassle-free process ensured that both buyer & seller to comply with tax regulations, avoiding any legal issues.

FAQs

1-Why is Form 26QB Important?

Form 26QB is not just a bureaucratic formality; it is a legal requirement. Non-compliance can lead to penalties and interest charges. Additionally, it ensures that the seller has paid the necessary taxes, which is crucial for the buyer to claim the property without any tax liabilities attached.

2-Who Needs to File Form 26QB?

The responsibility of filing Form 26QB lies with the buyer of the property. The buyer must deduct the TDS from the sale amount and submit it to the government. The seller must ensure that the buyer has filed this form correctly, as it affects their tax filings as well.

3-When to File Form 26QB?

Form 26QB must be filed within 30 days from the end of the month in which the property was purchased or the TDS was deducted. It’s crucial to file timely because any delay can lead to penalties and interest charges.

4-TDS Deduction: An Overview

TDS, or Tax Deducted at Source, is a mechanism used by the government to collect tax at the source of income. For property transactions, the rate of TDS is 1% of the sale consideration. This ensures that tax is collected at the time of the transaction, reducing the chances of tax evasion.

A-Calculating TDS for Form 26QB

Calculating TDS is simple. Here’s a formula:

TDS Amount = Sale Consideration x 1%

For instance, if the property is sold for ₹60 lakhs, the TDS amount would be ₹60,000. Factors like any advance payment and partial payments must be considered in the calculation.

B-Payment of TDS

Once TDS is calculated, it must be paid to the government. This can be done through net banking or by visiting authorized bank branches. The payment must be made within 30 days from the end of the month in which TDS was deducted.

C-Generating Form 16B

Form 16B is a TDS certificate issued by the buyer to the seller. It serves as proof that TDS has been deducted and deposited. Here’s how to generate it:

- Log in to the TRACES website.

- Select ‘Download Form 16B’.

- Enter the details of the property transaction and acknowledgment number from Form 26QB.

- Download the certificate.

5-Common Mistakes in Filing Form 26QB

Filing Form 26QB accurately is crucial. Common mistakes include incorrect PAN details, wrong property details, and errors in the TDS amount. Double-check all entries to avoid these errors. If mistakes occur, they can be rectified through the TRACES portal.

6-Penalties for Non-Compliance

Non-compliance with Form 26QB requirements can attract penalties. These include:

- A fee of ₹200 per day for late filing.

- Interest at 1.5% per month on the TDS amount for late payment.

Avoid these by ensuring timely and accurate filing.

7-What is the purpose of Form 26QB?

Form 26QB is used for reporting and depositing TDS deducted on property transactions exceeding ₹50 lakhs.

8-How can I correct a mistake in Form 26QB?

Mistakes in Form 26QB can be rectified through the TRACES portal by requesting a correction.

9-Is Form 26QB required for all property transactions?

No, Form 26QB is only required for property transactions where the sale consideration exceeds ₹50 lakhs.

10-What happens if I don’t file Form 26QB?

Failure to file Form 26QB can result in penalties and interest charges, making it crucial to comply with this requirement.

11-What are the consequences of a Late or Missing TDS Statement?

Please keep the following information in mind:

Both the buyer and the seller will face consequences if the TDS statement is not filed on time or if it is filed late. Here’s a summary of the impact on both parties:

a)- If Form 26QB is not filed on time or is filed late, the taxpayer will be charged under section 234E.

b)- If the non-compliance persists, a daily charge of Rs. 200 will be applied until it is rectified.

c)- Additionally, a fine may be imposed under section 271H.

d)- The buyer will be responsible for paying interest on any late tax deductions and deposits.

e)- If tax is not deducted, interest will be charged at a rate of 1% per month between the date the tax is supposed to be deducted and the actual deduction date.

f)- If tax is not deposited, interest will be charged at a rate of 1.5% per month from the date the tax is deducted until the actual payment date.

g)- If the buyer fails to file timely or at all, the seller will not be eligible to claim the tax credit.

12-How do I check the status of my Form 26QB filing?

You can check the status of your Form 26QB filing on the TIN NSDL website using the acknowledgment number.

Conclusion

Form 26QB is a critical component in property transactions in India. It ensures that TDS is deducted and deposited correctly, helping both buyers and sellers avoid legal complications. By following the guidelines and seeking expert advice, you can navigate this process smoothly.

Expert Insights: CA Sakshi Agarwal’s Advice

According to CA Sakshi Agarwal, “Timely filing and accurate details in Form 26QB are crucial. Buyers should keep a checklist and follow the guidelines meticulously to avoid penalties and ensure smooth transactions.”

Connect with Noida based,CA on Web for more information & best Tax advise.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.