To take a dig over false issuance of PAN cards for illegal purposes, the government of India has recently deactivated 11 Lakh PAN Cards following duplication. These de-activated PAN Cards were either allotted to a non-existent person or in the name of people with fake identities. It is worth mentioning that it is mandatory to link PAN with Aadhaar. Those who are skeptical about their PAN card status can follow the below-mentioned steps to check whether their PAN is active or it has been deactivated:-

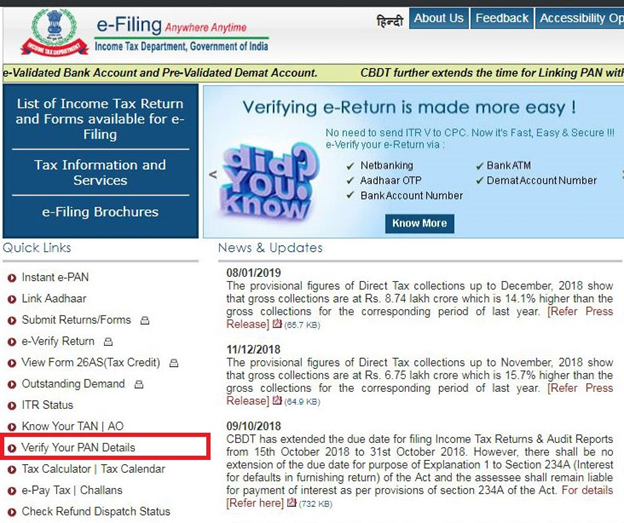

Step 1: Visit the official income tax department website https://www.incometaxindiaefiling.gov.in/home

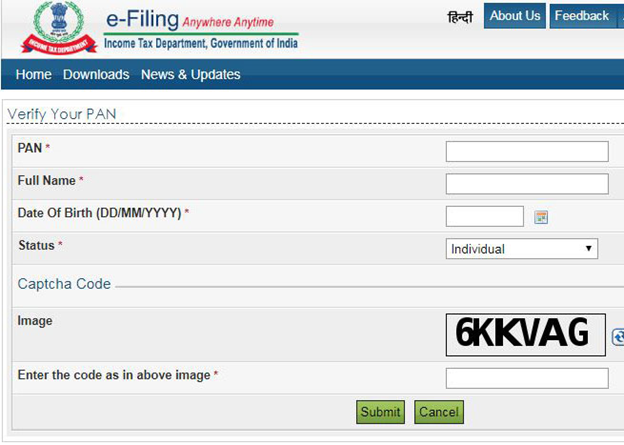

Step 2: Click on “Verify Your PAN Details” option under the ‘Quick Links”’ menu on the homepage by inputting some essential details such as your PAN Number, Full Name, DoB, Status and Captcha Code.

Step 3: Upon entering the details, click on ‘Submit’ after which you will receive an OTP on your registered mobile number.

Step 4: Enter the One Time Password, after which you will be directed to the page that will show you

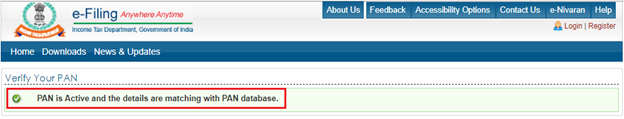

Step 5: The status of your PAN card under ‘remarks’ option – active or deactivated.

Step 6: The status of your PAN will be displayed on the screen.

Here’s a Sneak-Peek into the Details of PAN:-

A PAN card is made up of a ten-digit alphanumeric number that can be used to track financial transactions of an individual. Every tax paying citizen of India must possess a PAN card for smooth financial transactions both in India and abroad. As a general rule, one person should possess just one PAN card which can be helpful in following ways:-

- Tax deductions

- Starting a business

- Claiming funds

- Making investment

- Opening a bank account

- Buying and selling an immovable asset

- Buying RBI bonds and insurance

- Bank drafts and cash deposits

Why you should have a PAN card?

A PAN card is essential for every transaction made over and above Rs. 50,000/-. It also keeps a track of all financial transaction of an individual and companies that bring down the possibility of tax evasion. The pan card has your name, DOB, and photograph; it also serves as a nationally accepted identity proof for the cardholder.

The PAN card is useful when you purchase any vehicle, buy or sell immovable property, invest in shares or debentures over and above 1 lakh, and wish to open a new bank or demat account or while applying for a new credit card and several other transaction types.

How to Apply for a PAN Card?

A PAN Card can be applied both online and offline (which-so-ever is convenient). But before initiating any process, it is wise to keep all the documents handy. Also, note that the documents you provide in the PAN card application process must be valid at that time. The list of Documents required for Indian citizens for PAN card include:-

- Voter ID

- Aadhaar Card

- Passport copy

- ID card issued by the central or the state government authority

- Bank statement/credit card statement

- Water/electricity/gas bill

Note: All these can be used as a valid proof of address, identity, and Photo ID proof

The PAN Card Application Process

A PAN Card can be applied online and offline. To apply for it online, you can visit the NSDL portal or the UTIITSL website. The charges applied for a PAN card application is Rs 110/- for Indian citizens however for applicants residing outside India the payment of Rs. 1,020/- has to be made via credit/debit card, net banking, demand draft, etc.

To further ease the PAN application process and to make India digitalized, the income tax department has recently launched a mobile app called ‘Aaykar Setu’. It will allow customers to issue their PAN card using the Aadhaar e-KYC facility which will automatically verify the details of the customer. In addition to this, this app will also allow entities to pay taxes online, file refund and track income tax returns, TDS (tax deducted at source) with few simple clicks.

Below is the list of advantages that Aaykar Setu is sure to provide:

- It will save you a lot of time and make the PAN card application process less intrusive.

- Using this app from will help you resolve all your income tax issues with mere few simple clicks online.

- You can even personalize the Aaykar Setu’ app through a unique login ID and can file an income tax return using this app.

- With Aaykar Setu you can link your permanent account number with it and track all activities associated with your PAN card in few seconds.

- Using this app, you can make the process of getting PAN more hassle-free. It will also eliminate the role of private agents who charge hugely for issuing the PAN card and often delay the process as well due to their negligence. You can even use this new IT Dept’s mobile app to pay taxes online, apply for PAN online, ask queries from tax expert about tax payment on live chats, get quick tax calculation tool, etc.

These are quite significant details that would help you get your PAN Card with ease. Also if you have already applied for a PAN but your card has some minor spelling errors or if you need to make any corrections in your PAN, you can do the same online. Thanks to the government of India, the process of PAN is made simpler and effective with time. This has certainly made the lives of people a lot easier.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.