What are GST Returns?

Return means a statement of facts filed by taxpayers to tax authorities at regular intervals (monthly, quarterly, yearly, etc.). Similarly, GST returns are nothing but the statement of facts in a statutory format which is to be submitted to tax authorities regarding supplies made, input tax credit claimed and taxes paid by the taxpayer.

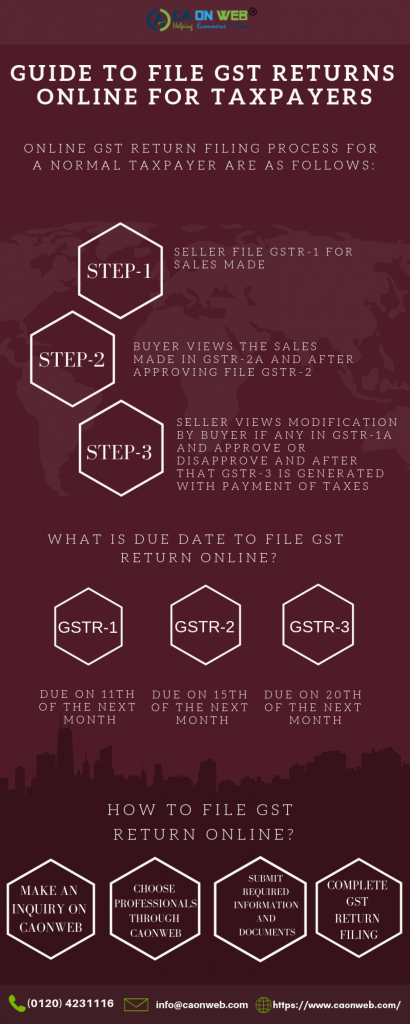

How GST returns are filed?

All the GST return filing processes are to be done electronically. The whole process of GST filing is online. Taxpayers can directly file gst return on the gst portal online. However, this may become time-consuming and tiresome with a huge number of invoices. For such cases, offline utilities have also been provided by the GSTIN (online common portal).

processes are to be done electronically. The whole process of GST filing is online. Taxpayers can directly file

What are the types of GST Returns?

Following are the various GST returns which are to be submitted by taxpayers

1.GSTR-1: Every taxpayer is required to furnish the details of outward supplies in form GSTR-1 except the following entities:-

a) Input service distributor (ISD)

b) Non-resident taxable person

c) Taxpayers who have opted for composition scheme

d) A supplier OIDAR services

e) Persons who are required to deduct tax deducted at source.

f) Persons who are required to collect tax collected at source.

Due Dates for filing GSTR-1

| Turnover | Due date |

| Taxpayers having a turnover more than INR 1.5 Crores. | 11th of the following month. |

| Taxpayers having a turnover less than INR 1.5 Crores. | 31st of next month from the end of the quarter. |

2. GSTR-3B: Every registered person is required to furnish a monthly return in form GSTR-3B on or before the 20th of next month, except the following entities:-

a) Input service distributor (ISD)

b) Non-resident taxable person

c) Taxpayers who have opted for composition scheme

d) A supplier OIDAR services

e) Persons who are required to deduct tax deducted at source.

3.GSTR-4: Every registered taxpayer who has opted for composition scheme is required to file GSTR-4 on a quarterly basis on or before the 18th of the month of succeeding quarter.

4.GSTR-5: Registered non-taxable persons not having a business establishment in India and have come for a short period to make supplies are required to file monthly return in form of GSTR-5. They generally make imports and make local outward supplies. Due Date for filing GSTR-5 is 20th of next month.

5. GSTR-6: Every Input service distributor is required to furnish details of input tax credit received and distributed by filing a monthly return in form of GSTR-6 on or before the 13th of the next month. ISD is not required to furnish details of outward supplies.

6. GSTR-7: Entities who are required to deduct TDS under GST are liable to furnish GSTR-7. Following entities are required to deduct tax:

a) Central/State government department or establishment

b) A local authority

c) Government Agencies

GSTR-7 is required to be furnished on or before 10th of the next month in which tax was deducted.

7. GSTR-8: Every taxpayer who owns or controls a digital platform for e-commerce and is required to collect TCS is liable to file GSTR-8. GSTR-8 is required to be furnished on or before 10th of the next month.

8. GSTR-9: Every taxpayer registered under GST is required to file a GST annual return in the form of GSTR-9. It is required to be filed for every financial year on or before 31st December in the subsequent financial year. It is a consolidation of all the returns filed related to that financial year. CBIC has extended the date for the financial year 2017-18 to 30 June 2019

9. GSTR-10: Every registered taxpayer whose registration has been canceled or surrendered is required to file a final return electronically on the common portal. It has to be filed within 3 months of the date of cancellation or date of the order of cancellation, whichever is later.

How to File GST Return Online-?

What is the Cost of GST Return Filing?

There is no fixed amount for the cost of GST return filing in India. It entirely depends upon a number of factors, important ones are mentioned below:

1. Type of Scheme you have opted for (regular/composition scheme).

2. Number of transaction of outward supplies per month.

3. Brand value of that particular consultancy firm.

4. Type of entity.

5. Annual Turnover of the entity.

Some consultants charge heavy amounts for all these compliances but one should always weigh his or her option before opting for any particular consultancy firm. Ultimately, the cost of all these compliances should not exceed the benefits attained from them.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.