🔊 Play CGST is a part of Goods and Service Tax (GST) CGST means Central Goods and Service Tax, one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax one nation. CGST falls under Central Goods and Service Tax Act 2016. For easy understanding, when […]

Category: GST

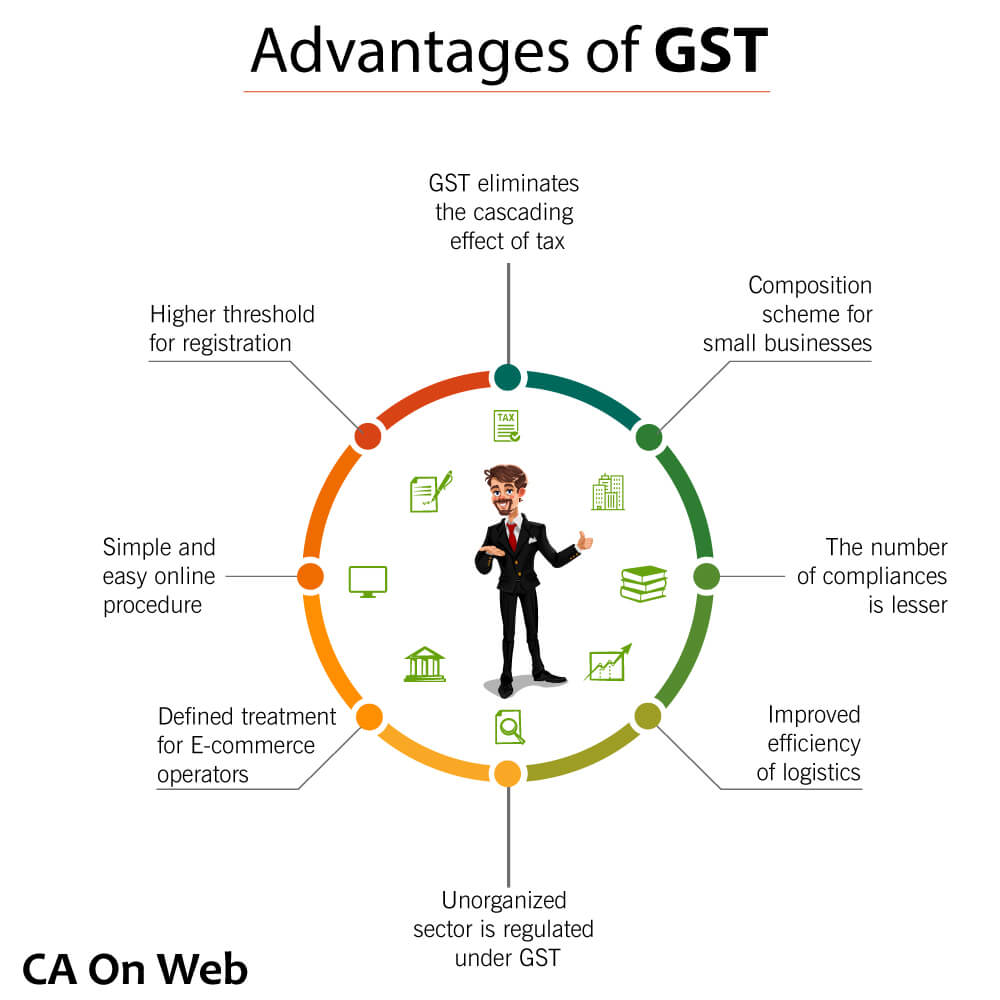

Advantages of GST

🔊 Play GST Eliminates the Cascading Effect of Tax GST is a comprehensive indirect tax that was designed to bring the indirect taxation under one umbrella. More importantly, it is going to eliminate the cascading effect of tax that was evident earlier. Cascading tax effect can be best described as ‘Tax on Tax’. Let us take […]

Getting Gst Registration Is Done Online Without Any Hassle

🔊 Play GST registration is required if your annual aggregate turnover Exceeds 20 Lakhs Rupees. In certain cases, you will need a GST number on a mandatory basis even if your turnover is within the threshold limit. What is an aggregate turnover? Aggregate turnover includes the aggregate value of: (i) all taxable and non-taxable supplies, […]

Getting Registration of GST number Is Done Online Without Any Hassle

🔊 Play GST registration is required for businesses whose Businesses whose turnover exceeds INR 40 lacs (Normal States) & INR 20 lacs (Special category states). GST registration is a process of indirect taxation which is applicable in most of the countries in the customised form, which has also replace VAT the erstwhile indirect taxation method in […]

Impact of Goods and Services Tax on Hotel Industry

🔊 Play “Athithi Devo Bhavha” (Guest is God) has been one of the central tenets of Indian culture since times immemorial. Today, the hospitality sector (which includes tourism also) is one of the fastest growing sectors in India and is expected to grow at the rate of 8 % between 2007 and 2016. The boom in […]

Job Work under GST

🔊 Play Job work has been defined under Section 2(62) of the Model GST Law as “undertaking any treatment or process by a person on goods belonging to another registered taxable person and the expression “job worker” shall be construed accordingly”. The expression “job work” refers to a “treatment” or “process”, which is undertaken by […]

WHAT IS THE GST REGISTRATION PROCEDURE

🔊 Play GST REGISTRATION PROCEDURE The taxation system for goods and services in India is defined by a cascading tax structure which leads to slower economic growth. To remove this problem, a uniform and a simple tax system like GST (Goods and Service Tax) is needed to unite the nation. The main expectation from this […]

How much should you be charged on food Bills/All your concerns about food bills after GST

🔊 Play Someone mentioned on twitter how she is planning to cut off her outdoor eating habits as she feels the surge in bills post GST. When we asked her how much was she charged post-GST, She had no clue about the rates. Well, that’s bad we thought. Being aware of basic rates is very […]

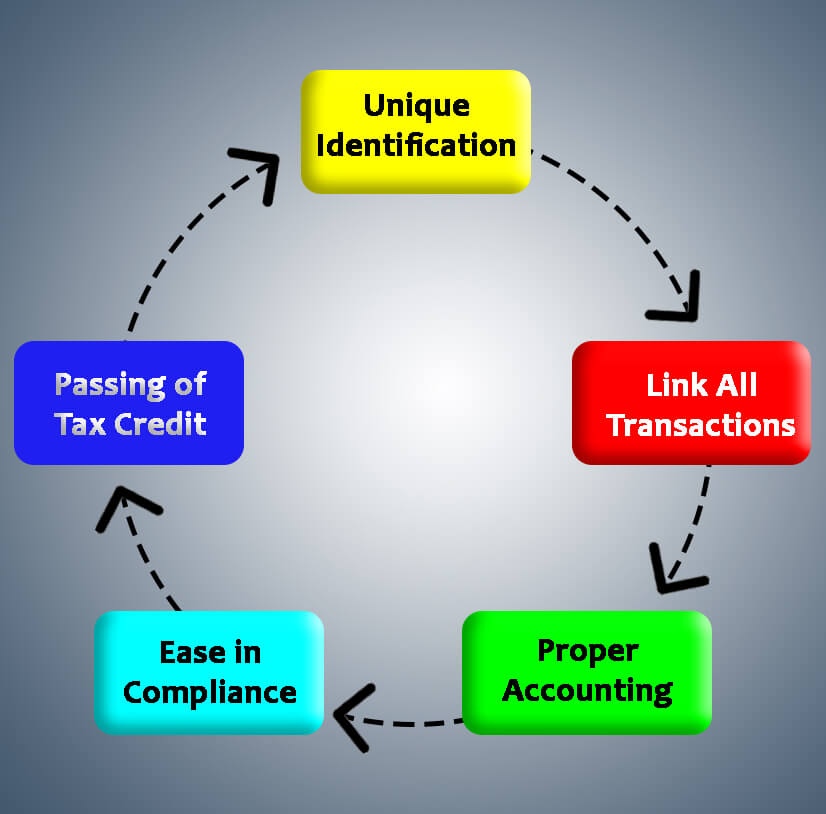

Unique Identification Number(UIN)

🔊 Play Grant of Unique Identification Number(UIN) Any specialized agency of the United Nations Organization or any Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947), Consulate of Embassy of foreign countries ; Any other person or classes of person notified by the Commissioner shall obtain […]

What is Debit Note and Credit Note?

🔊 Play What is Debit Note and Credit Note? When goods supplied are returned or when there is a revision in the invoice value due to goods (or services) not being up to the mark or extra goods being issued a Debit Note or Credit Note is issued by the supplier and receiver of goods […]