-

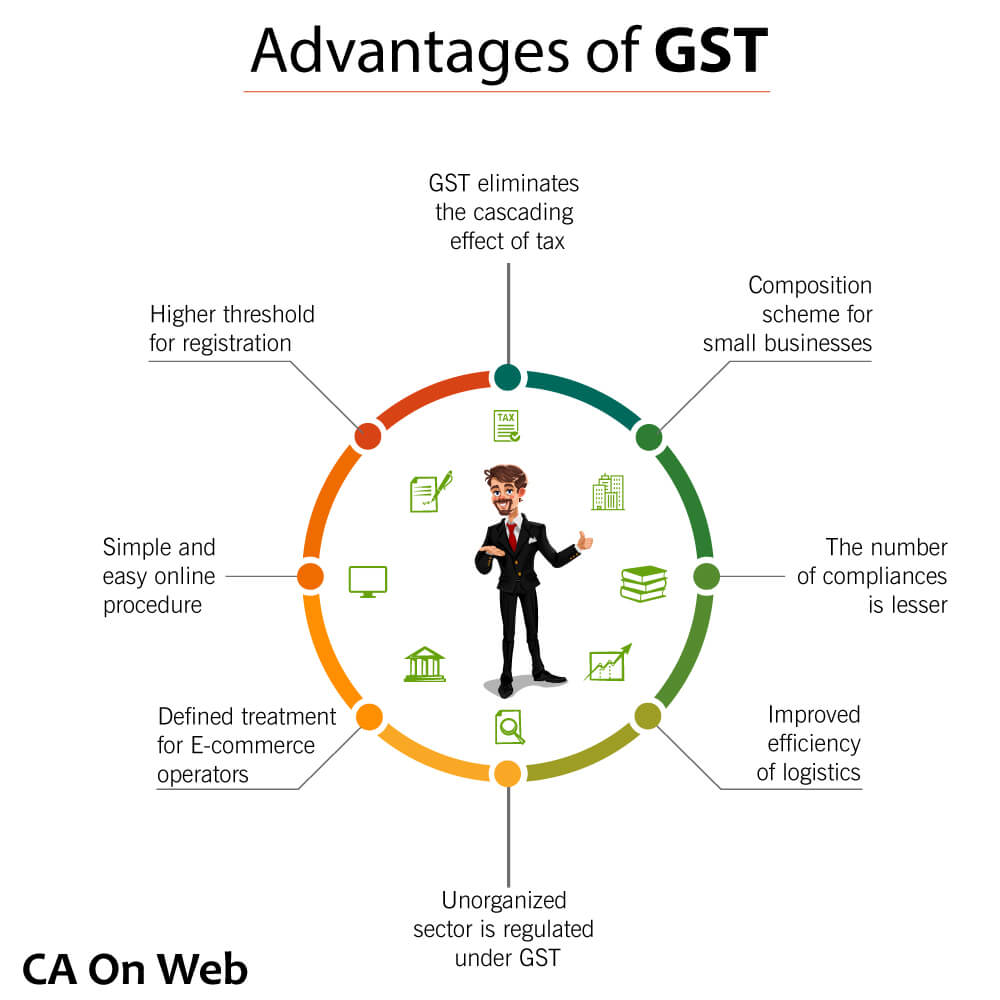

GST Eliminates the Cascading Effect of Tax

GST is a comprehensive indirect tax that was designed to bring the indirect taxation under one umbrella. More importantly, it is going to eliminate the cascading effect of tax that was evident earlier.

Cascading tax effect can be best described as ‘Tax on Tax’. Let us take this example to understand what is Tax on Tax:

Before the GST Regime:

A consultant offering services for say, Rs 50,000 and charged a service tax of 15% (Rs 50,000 * 15% = Rs 7,500).

Then say, he would buy office supplies for Rs. 20,000 paying 5% as VAT (Rs 20,000 *5% = Rs 1,000).

He had to pay Rs 7,500 output service tax without getting any deduction of Rs 1,000 VAT already paid on stationery.

His total outflow is Rs 8,500.

Under GST

| GST on service of Rs 50,000 @18% | 9,000 |

| Less: GST on office supplies (Rs 20,000*5%) | 1,000 |

| Net GST to pay | 8,000 |

-

Higher Threshold for Registration

Earlier, in the VAT structure, any business with a turnover of more than Rs 5 lakh (in most states) was liable to pay VAT. Please note that this limit differed state-wise. Also, service tax was exempted for service providers with a turnover of less than Rs 10 lakh.

Under the GST regime, however, this threshold has been increased to Rs 20 lakh, which exempts many small traders and service providers.

Let us look at this table below:

| Tax | Threshold Limits |

| Excise | 1.5 crores |

| VAT | 5 lakhs in most states |

| Service Tax | 10 lakhs |

| GST | 20 lakhs (10 lakhs for NE states) |

-

Composition Scheme for Small Businesses

Under GST, small businesses (with a turnover of Rs 20 to 75 lakh) can benefit as it gives an option to lower taxes by utilizing the Composition Scheme. This move has brought down the tax and compliance burden on many small businesses.

-

Simple and Easy Online Procedure

The entire process of GST (from registration to filing returns) is made online, and it is super simple. This has been beneficial for start-ups especially, as they do not have to run from pillar to post to get different registrations such as VAT, excise, and service tax.

-

The Number of Compliances is Lesser

Earlier, there was VAT and service tax, each of which had their own returns and compliances. Below table shows the same:

Under GST, however, there is just one, unified return to be filed. Therefore, the number of returns to be filed has come down. There are about 11 returns under GST, out of which 4 are basic returns which apply to all taxable persons under GST. The main GSTR-1 is manually populated and GSTR-2 and GSTR-3 will be auto-populated.

-

Defined Treatment for E-commerce Operators

Earlier to GST regime, supplying goods through e-commerce sector was not defined. It had variable VAT laws. Let us look at this example:

Online websites (like Flipkart and Amazon) delivering to Uttar Pradesh had to file a VAT declaration and mention the registration number of the delivery truck. Tax authorities could sometimes seize goods if the documents were not produced.

Again, these e-commerce brands were treated as facilitators or mediators by states like Kerala, Rajasthan, and West Bengal which did not require them to register for VAT.

All these differential treatments and confusing compliances have been removed under GST. For the first time, GST has clearly mapped out the provisions applicable to the e-commerce sector and since these are applicable all over India, there should be no complication regarding the inter-state movement of goods anymore.

-

Improved Efficiency of Logistics

Earlier, the logistics industry in India had to maintain multiple warehouses across states to avoid the current CST and state entry taxes on inter-state movement. These warehouses were forced to operate below their capacity, giving room to increased operating costs.

Under GST, however, these restrictions on inter-state movement of goods have been lessened.

As an outcome of GST, warehouse operators and e-commerce aggregators players have shown interest in setting up their warehouses at strategic locations such as Nagpur (which is the zero-mile city of India), instead of every other city on their delivery route.

Reduction in unnecessary logistics costs is already increasing profits for businesses involved in the supply of goods through transportation.

-

Unorganized Sector is Regulated under GST

In the pre-GST era, it was often seen that certain industries in India like construction and textile were largely unregulated and unorganized.

Under GST, however, there are provisions for online compliances and payments, and for availing of input credit only when the supplier has accepted the amount. This has brought in accountability and regulation to these industries.

Let us now look at the disadvantages of GST. Please note that businesses need to overcome these disadvantages to run the business smoothly.

Chartered Accountant by profession, CA Sanket Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.

It is very amazing . Thank you for sharing great post