TDS is abbreviation of Tax Deducted at Source. TDS filing is one of strategy utilized for gathering income tax in India. It is administered under the Indian Income Tax Act 1961 and overseen by Central Board of Direct Taxes (CBDT). Under this demonstration, any installment secured under these arrangements will be paid in the wake of deducting recommended rate. It is a piece of the Department of Revenue and overseen by Indian Revenue Service (IRS). In an association, the business gathers charge from their representative and sends it straightforwardly to the personal assessment office.

This tax must be stored in treasury of Indian Government inside a predefined time. There is no uniform pace of finding for this duty. It might be run from 1% to 30% or more, contingent upon the element on which it is appropriate. There are two personalities engaged with the procedure of TDS filing; one is Deductor and the other is Deductee. The Deductor is an individual or an organization/association who is in charge of deducting the cash (charges) before the installment is made and the Deductee is the individual who is at risk to make good on the regulatory obligation or from whom the duty is deducted.

Basically, TDS is deducted on following area where one should match with the criteria before TDS filing like;

- Salaries

- Interest payments by banks

- Commission payments

- Rent payments

- Consultation fees

- Professional fees

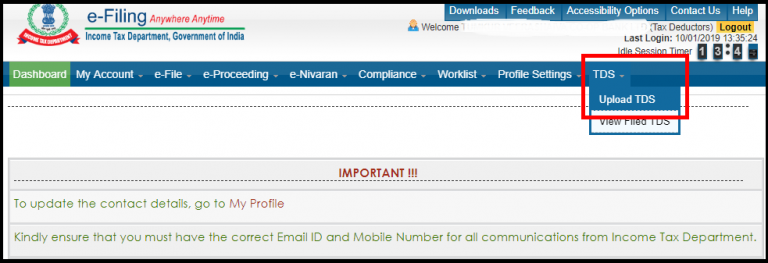

Procedure to Upload TDS Statement, to file online TDS return

- Login with your credentials on http://www.incometaxindiaefiling.gov.in/home

- You will sked to fill username, password and captcha code; Note: user name will be your TAN number

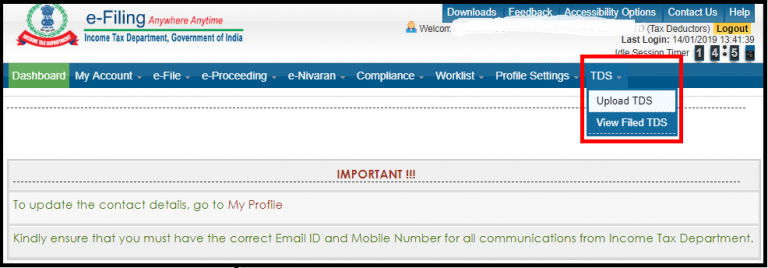

- After login go to TDS section mentioned in the menus

- Click on the upload TDS

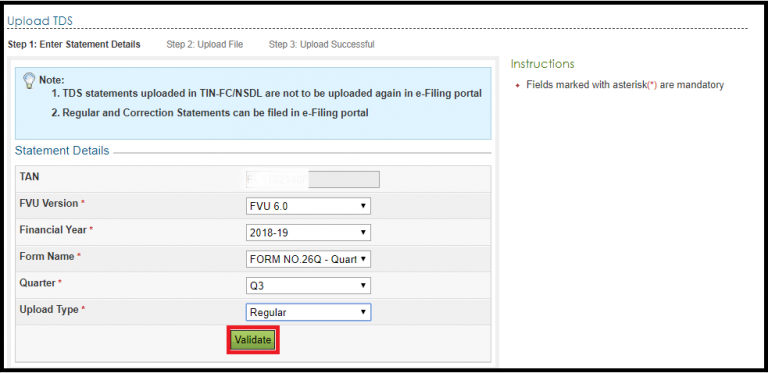

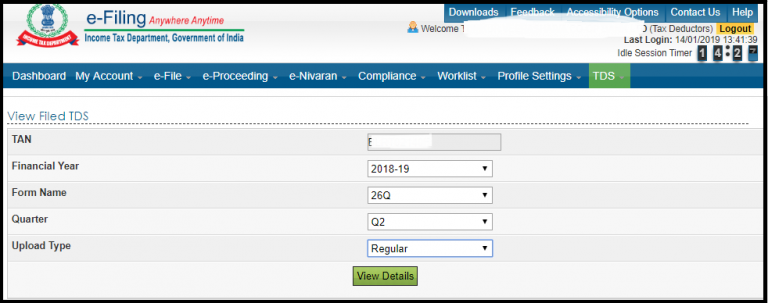

- You will be asked to fill some details in the form like FVU version, Financial year, Form name, Quarter, and upload type.

- Note: upload type will be regular while filling TDS filing.

- After filling above mentioned details, click on validate, which will validate the statements mentioned by you in the form.

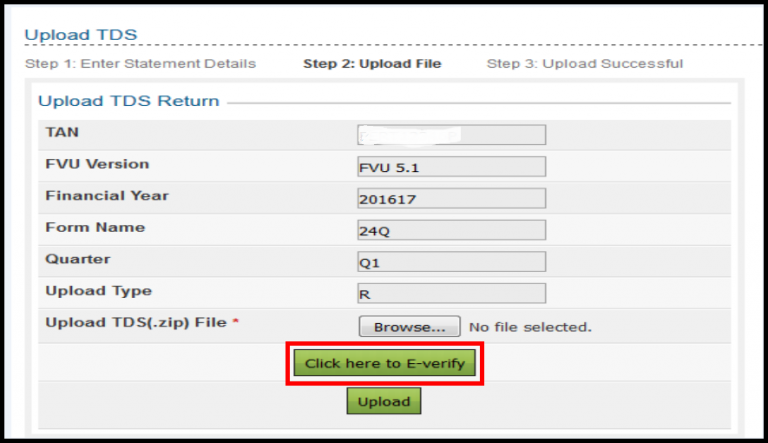

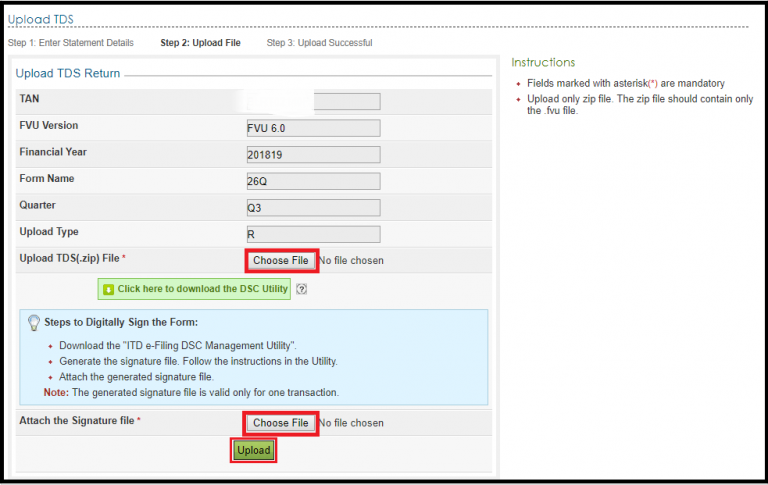

Upload TDS Statement using DSC in online TDS Return

- Above mentioned steps will be remaining same, update the TDS zip file which was prepared by using the utility downloaded from tin-NSDL website.

- Attach the signature file by clicking on browse button

- Now click on upload button.

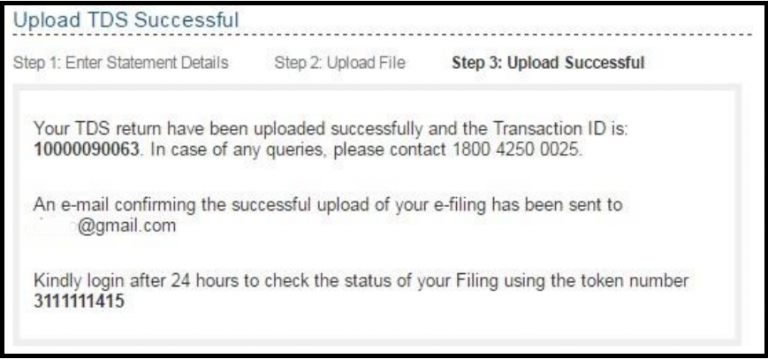

- It will show a message with transaction id and also sent a copy to the registered email id.

Upload TDS statement using EVC in TDS filing

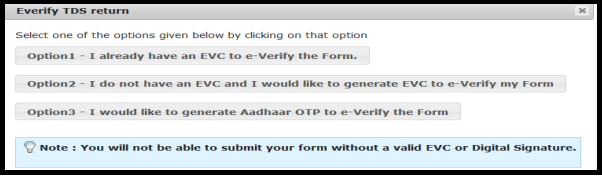

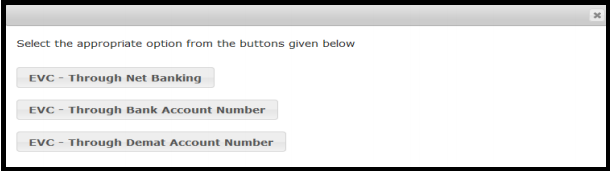

All the steps mentioned above will remain same except e-verify. You will see a e-verify button at the bottom, after clicking E-verify button, three option will be provided like

In option 1 you will see text like “I already have an EVC to e-Verify the Form”

In option 2 you will see “I do not have an EVC and I would like to generate EVC to e-verify my form”

And in Option 3 you will see “I would like to generate Aadhaar OTP to e-verify the form”.

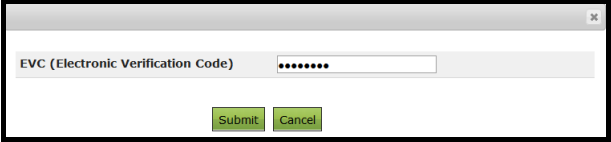

If you have selected 1 option, then you have to fill EVC number and click on submit.

If you have selected 2 option, then it will further provide to three another options like

- EVC through net banking

- EVC through account number

- EVC through demat account number

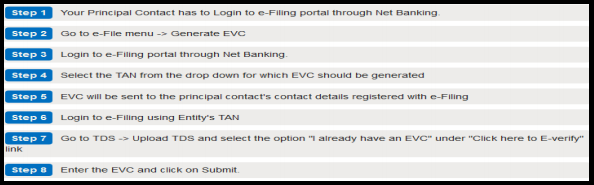

EVC through net banking

- Login to the e-filing portal through networking

- Click on e-file menu then generate EVC.

- Select the required TAN number from the drop down menu.

- EVC will be sent on the registered mobile number.

- Now login to the e-filing portal again.

- Go to TDS section, click on upload TDS, then select the option that I already have an EVC under click here to e-verify.

- Enter the EVC and click on submit.

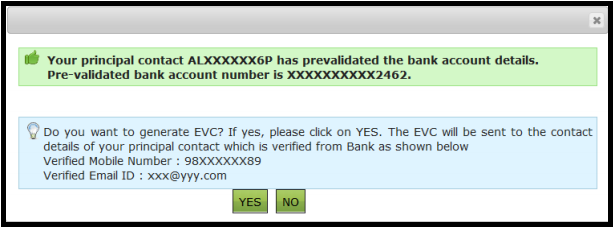

EVC through account number

To go through this option note that you bank details must be registered with the account.

It will provide you confirmation message that something like “Do you want to generate EVC then click yes”. After clicking on yes, EVC number will be sent to the registered mobile number.

Read another blog: Seven Steps for Private Limited Company Registration in Delhi

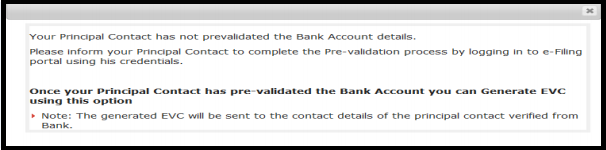

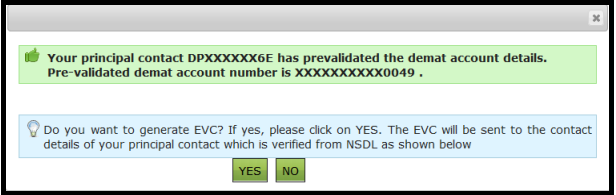

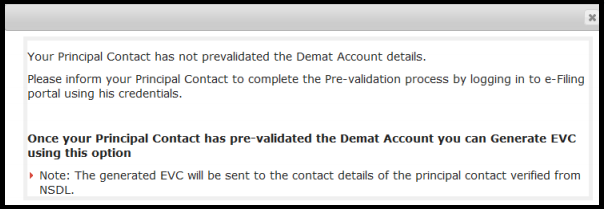

EVC through demat account number

In this case also demat account details should be pre validated else it will provide you a message like account details has not been validated.

It will also provide you confirmation message that something like “Do you want to generate EVC then click yes”. After clicking on yes, EVC number will be sent to the registered mobile number.

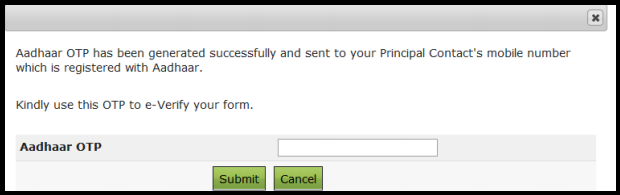

When you will select option 3 for TDS filing

- Note: Mobile number should be registered with Aadhaar card. Then only you will receive OTP on registered number. After the click on submit.

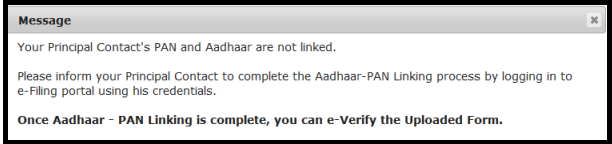

- Else it will show a message like PAN and Aadhaar card are not linked.

To File TDS return, there are some due dates declared by government according to 2018-19

- 1st quarter would start from 1st April to 30th June therefore, TDS return due date would be 31st August 2018.

- 2nd quarter would start from 1st July to 30th September therefore, TDS return due date would be 31st October 2018.

- 1st quarter would start from 1st October to 31st December therefore, TDS return due date would be 31st January 2019.

- 1st quarter would start from 1st January to 31st March therefore, TDS return due date would be 31st May 2019.

Get Import Export Code Online on lowest cost.

Various forms available to file TDS return

- Form 24Q for TDS on salary

- Form 27Q for when deductee is foreigner or running foreign company/ non resident

- Form 26QB when installment for exchange of unmovable property

- Form 26Q TDS in any other case.

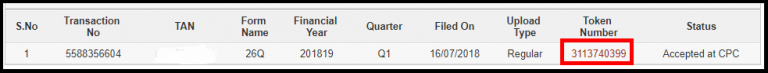

You can also see the TDS return status by following below steps:

- Login to the portal with credentials

- Click on TDS

- Click on View filed TDS.

- Then again you have to provide information related to financial year, form name, and quarter.

- Now click on view details button.

- It will show you all the TDS return status.

If you are still facing any issue then you are free to call on (0120) 4231116, where our expert will guide you.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.