🔊 Play This article is exclusively for VAT that is going to be implemented in UAE from Jan 2018. As you know VAT will be introduced across the UAE on 1st Jan 2018 at a standard rate of 5% you should start preparing for the same without any delay, the major changes in your business […]

Impact of Goods and Services Tax on Hotel Industry

🔊 Play “Athithi Devo Bhavha” (Guest is God) has been one of the central tenets of Indian culture since times immemorial. Today, the hospitality sector (which includes tourism also) is one of the fastest growing sectors in India and is expected to grow at the rate of 8 % between 2007 and 2016. The boom in […]

Job Work under GST

🔊 Play Job work has been defined under Section 2(62) of the Model GST Law as “undertaking any treatment or process by a person on goods belonging to another registered taxable person and the expression “job worker” shall be construed accordingly”. The expression “job work” refers to a “treatment” or “process”, which is undertaken by […]

How to apply for import export code

🔊 Play IEC import export code being a mandatory certificate for any person who wants to start the business of import or export of goods or services, every person starting an import-export business will have to apply for import export code. Applying for Import export code with the best service provider in India is a […]

Import Export Code in India

🔊 Play IEC registration is required by a person for exporting or importing goods. Obtaining import export code is compulsory for all those who are having an import-export business. It is a 10 digit code which is issued by the (DGFT) Directorate General of Foreign Trade . All businesses which are engaged in Import and […]

NRI Services

🔊 Play NRI Services CA ON WEB will help NRIs by: Determining residential status: We help you to know about whether you qualify as an Indian resident for a financial year or considered as a Non-Resident Individuals. You are considered as NRI if you do not meet any of these two conditions: When you are in […]

Bookkeeping & Outsourcing

🔊 Play Book Keeping: One should realize the importance of bookkeeping at an early stage of business. There are many who incorporate companies/start businesses, however, fail to recognize the importance of bookkeeping. Bookkeeping is an important aspect to run your business successfully in order to ensure that your all types of tax filing goes correct […]

WHAT IS THE GST REGISTRATION PROCEDURE

🔊 Play GST REGISTRATION PROCEDURE The taxation system for goods and services in India is defined by a cascading tax structure which leads to slower economic growth. To remove this problem, a uniform and a simple tax system like GST (Goods and Service Tax) is needed to unite the nation. The main expectation from this […]

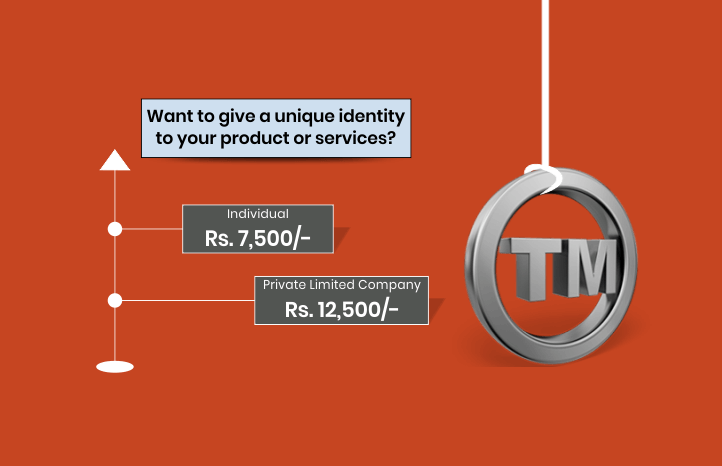

Trademark Registration

🔊 Play Trademark is a symbol of your business.A trademark helps BUILD VALUE of your product/service/business. It helps distinguishes your product or services with others. If you have a trademark but not registered you cannot take legal action in case of infringement of your trademark by others. Trademark registration is an investment for your business […]

TDS Return Online

🔊 Play TDS (Tax Deducted at source) is a form of indirect tax collected by the revenue authorities of the Indian government as per the Income Tax Act 1961. This tax is usually collected at the time of generation of income or rather at the time of making payment. It is the amount deducted from […]