A complete beginner’s level guide for Startup India registration

We all have a creative & unique business idea with us; and we all have a big shot dream of staring our own venture. But what is pulling all of us back is lack of adequate knowledge and direction needed to go for Startup India registration. Here is the complete guide of how to effectively manage company registration in India with complete list of compliance details required to be fulfilled.

According to the recent report by NASSCOM, India possesses the 3rd largest Startup ecosystem in the world. In terms of volume and the types of Startup India registration holds a much laudable rank amongst its various counterpart nations. People want to start their venture under the new Startup India registration scheme which was introduced by the government back in 2016.

VARIOUS STAGES IN STARTUP REGISTRATION CYCLE

| PRE-STARTUP | STARTUP | GROWTH |

| Discovery: Identifying a product/service for target customer base. Validation: As your product hits the market & its sale has started then comes the validation stage. | Efficiency: Business model must be structured in such a way that it raises your customer base exponentially. Scale: Pushing the business production capacity to ultimately increase business growth in a sustainable manner. | Maintenance: Maintaining business operations in such a manner that during the tough times it does not collapse. Sale/renewal: It is the final stage of any business cycle where the promoters plan to sell it out. |

However to kick-start your amazing journey of having your own Startup venture in India, everyone needs to follow a certain set of compliance laws which are as follows:

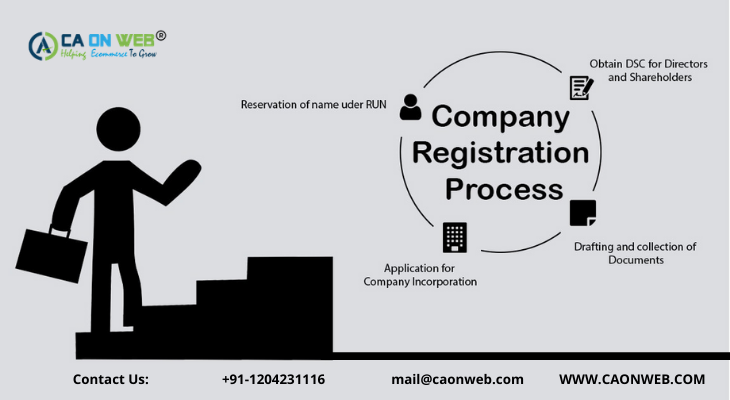

SIMPLIFIED COMPANY REGISTRATION PROCESS IN INDIA

Government regulates company registration process under the mandate of Ministry of corporate affairs. Following are some of the important steps which need to be look after during Startup India registration process:

📢 Register your Company 3999₹

1.) Name the company

Choosing a name is the most essential step in company registration process as it helps in distinguishing your brand from your competitors in the market. Choosing the right name will that goes with the nature of your business will definitely prove to be a game changer in near future of the company’s life cycle.

2.) Type of company registration:

There are basically 4 types of business structure formations:

Limited Liability Company (LLC):

- LLP is the most opted out method of company registration in India because of the flexibility & perks of having a limited liability.

- Limited liability Company so formed is a separate legal entity from its partners & both possesses a different liability level.

- Under LLC liability of the partners is limited to their agreed contribution.

Private Limited Company registration (PLC):

- PLC has a different business character in terms of ownership, risk & reward as compared to other forms of companies.

- However, they represent a crucial organizational form for conduct of business.

One Person Company (OPC):

- The concept of One Person Company (OPC) registration was introduced for the first time under companies act, 2013.

- Unlike a Private Company where a minimum of 2 Directors are required an OPC can be formed with just one director as its member.

3.) Apply for digital signature certificate (DSC): It is important to apply for Digital signature certificate (DSC) since it is the most trusted way of authorising and verifying the documents. Digital signature certificates are safer & secure as compared to the hand signatures.

4.) Apply for Director Identification number (DIN): DIN is a unique identification number which is associated with existing or the potential director a company so incorporated. As per companies act, 2013 every individual who intends to become a director in a company, must obtain a directors identification number (DIN).

📢 File GST Return 999₹

5.) Submit your MOA/AOA documents: Memorandum & articles of association forms the basis for the functioning of the company. MOA/AOA defines the rules & regulations of the company’s vision & mission. The document lays down various guidelines about the tasks that need to be performed within the company.

6.) Apply for PAN/TAN: Permanent account number (PAN) & Tax deduction & collection account number (TAN) is an important document in company registration process for every business since this will help in online ITR filing & keep a record of it.

7.) Collect Incorporation certificate: After successful Submission of all the documents with the authorities within the stipulated time period a pre-screening of the documents is being done before releasing company incorporation certificate.

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.