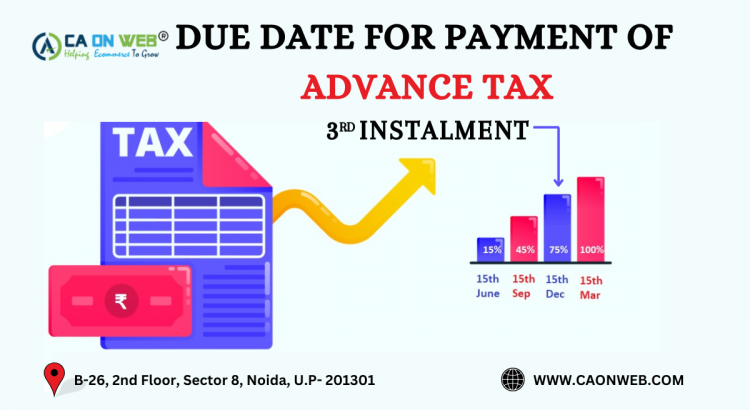

🔊 Play Taxpayers are required to settle 75% of their advance tax obligation by December 15, 2024. Advance tax, commonly called income tax paid in advance for earnings within the same financial year, is an integral part of tax compliance. Often called ‘pay-as-you-earn’ tax, individuals and businesses with a tax liability of Rs 10,000 or […]

Category: Taxation

Tax Consultation with a Tax Expert on a Phone call | CAonWeb

🔊 Play An online tax consultant is a specialist who works in a variety of fields, including international tax, transfer pricing, income tax counseling, and GST expert in Delhi. Tax Consultation involves in-depth subject knowledge and thorough analysis. With the help of Mr. Sanket Agrawal, you can get all importance of tax advice. He has helped many companies for maintaining tax […]

ALL ABOUT INCOME TAX RETURN FILING

🔊 Play A person keeps track of their earnings, expenses, tax deductions, investments, and taxes in an income tax return. Even if there is no income, a taxpayer must file an income tax return to report their annual earnings. This blog includes details on the electronic IT Return Filings, the steps involved, the benefits of doing […]

INCOME TAX RETURN FILING FY 2021-22 | AY 2022 -23

🔊 Play Since last year, the Income Tax Department has been quite vigilant in ensuring that Income tax return compliance in our country is as strengthen as much possible. The department’s goal is very clear, it wants you are complied with the laws for the time being in force with a move to operations online […]

INCOME TAX RETURN FILING IN INDIA

🔊 Play Individuals/HUFs/Associations/Businesses provide information about their income throughout the financial year and, if applicable, file their Income tax return electronically. Once the assessee’s final income is computed from all sources and subsequent income tax is computed, the process of Online Income tax filing begins. Different ITR Forms are required depending on the sources of […]

INCOME TAX RETURN FILING

🔊 Play Income tax is a tax forced by the Central Government on the income of a person. Every citizen is responsible for Income tax filing. The IT department examines these income declarations, and if any sum has been paid in error, the excess is refunded to the assessee’s bank account. To avoid penalties, all […]

Income Tax Fundamentals for the Assessment FY- 20-21

🔊 Play What is income according to the Income Tax Act? The term “income” has a very broad and inclusive meaning that is defined in Section 2(24) of the Income Tax Act; we will try to understand it broadly without going into too much detail. Income from Salary: This is the amount you receive from your employer […]

CAPITAL GAIN ON SALE OF HOUSE PROPERTY

🔊 Play Looking forward to sell your property? Save yourself from paying long term capital gains tax on sale of property in India Generally people don’t realise that they need to pay tax on the profit they have earned on sale of their house property which unknowingly makes them non-compliant with income tax guidelines. But […]

Best Platform for All the Accounts Tax Professionals Around The World

🔊 Play CAONWEB, best platform for all the accounts/Tax professionals around the world, Read how: You are taxation or accounts service provider, You may be a CPA, a Chartered Accountant, A Public Accountant- You work is related to bookkeeping, tax computing, return filing, certification, legal entity incorporation- then caonweb.com is the best platform for you. […]

Cross Border Transaction – Structuring & Taxation

🔊 Play We have extensive experience in developing optimal tax structures for both inbound investments and outbound investments. The structuring of inbound and outbound investments starts with an understanding of expansion plans and objectives of the business. And, then a careful analysis of the applicable tax rules and rates for the home country and foreign […]