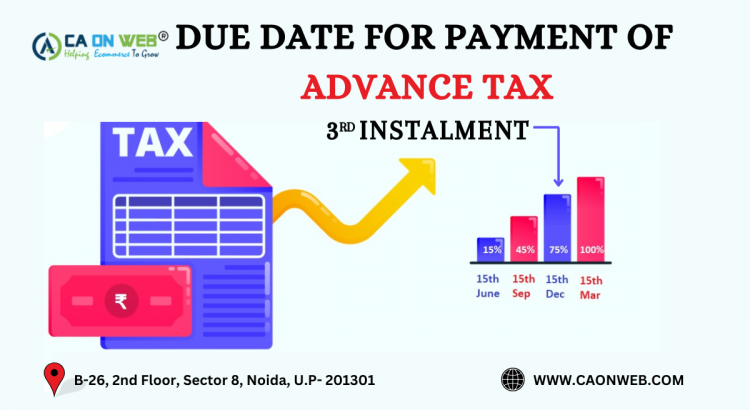

🔊 Play Taxpayers are required to settle 75% of their advance tax obligation by December 15, 2024. Advance tax, commonly called income tax paid in advance for earnings within the same financial year, is an integral part of tax compliance. Often called ‘pay-as-you-earn’ tax, individuals and businesses with a tax liability of Rs 10,000 or […]

Category: TDS Return

FORM 26QB: TDS ON SALE & PURCHASE OF PROPERTY

🔊 Play CONTENTS OF TOPIC S.No. Particulars 1 Introduction 2 Requirements associated with Form 26QB 3 Steps to fill Form 26QB Steps to Download Form 16 4 Illustration on successful filing of Form 26QB 5 FAQs 6 Conclusion 7 Expert Insights Introduction to 26QB Under Section 194-IA of the Income Tax Act, 1961, when […]

NEW TDS RATES EFFECTIVE FROM 14TH MAY 2020. HERE IS THE LIST OF MOST COMMON HEADS!

🔊 Play File TDS Return Online SECTION NATURE CURRENT (TILL 13TH MAY) RATE EFFECTIVE FROM 14TH MAY 2020 TO 31ST MARCH 2021 194 J Payment of Professional Fees etc. 10 % *in certain cases like royalty, technical service fees rate is 2% 7.5 *in certain cases like royalty, technical service fees rate is 1.5% 194 […]

How to File TDS return Online and when is the right Time to file?

🔊 Play TDS is abbreviation of Tax Deducted at Source. TDS filing is one of strategy utilized for gathering income tax in India. It is administered under the Indian Income Tax Act 1961 and overseen by Central Board of Direct Taxes (CBDT). Under this demonstration, any installment secured under these arrangements will be paid in […]

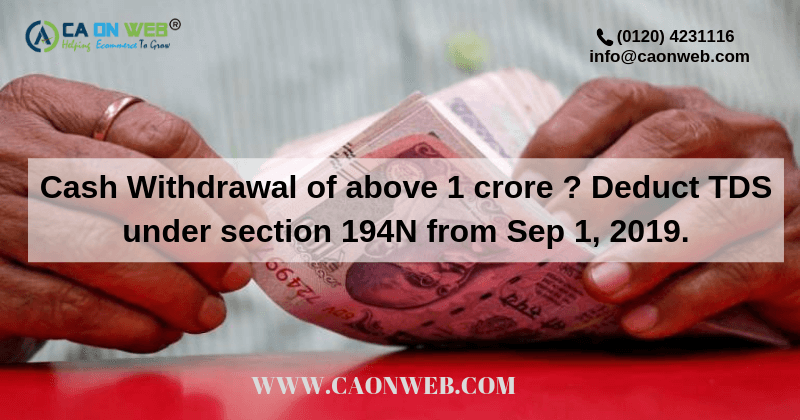

Cash Withdrawal of above 1 crore? Deduct TDS under section 194N from Sep 1, 2019.

🔊 Play The objective of introducing Section 194N by government in the Union Budget 2019 of July 2019 is to discourage cash transactions in the country and promote the digital transaction in India or promote less cash economy. ‘Section 194N –TDS on cash withdrawals over and above Rs 1 crore’ has been introduced through the Finance […]

TDS ON PROPERTY UNDER SECTION 194-IA OF INCOME TAX ACT

🔊 Play APPLICABILITY OF TDS Any person who is purchasing an immovable property (other than rural agricultural land) worth Rs. 50 lakh or more is required to pay withholding tax at the rate of 1% from the consideration payable to a resident transferor. This section covers residential property, commercial property, as well as land. However, […]

TDS Rates for FY 2018-19

🔊 Play For Persons Resident in India: Particulars TDS Rate (%) Section 192: Payment of salary Normal Slab Rate Section 193: Interest on securities. a) any debentures or securities for money issued by or on behalf of any local authority or a corporation established by a Central, State or Provincial Act; b) any debentures issued by a […]

TDS Return Online

🔊 Play TDS (Tax Deducted at source) is a form of indirect tax collected by the revenue authorities of the Indian government as per the Income Tax Act 1961. This tax is usually collected at the time of generation of income or rather at the time of making payment. It is the amount deducted from […]

TDS Return

🔊 Play TDS Return Filing in India TDS (Tax Deducted at Source) is a form of indirect tax collected by the revenue authorities of the Indian government as per the Income Tax Act 1961. This tax is usually collected at the time of generation of income or rather at the time of making payment. Tax […]