“A Private Ltd. Company may be a company which is privately held for little businesses. The responsibility of the members of a Private Ltd. is restricted to the quantity of shares respectively held by them. Shares of Private Ltd. can’t be publically traded. All the aspects of Private Ltd. are discussed within the article”.

The administration of such a corporation is Ministry of Corporate Affair (MCA).

Private Ltd Company:-

As Section 2, Clause 68 of Companies Act 2013, “Private Ltd Company” means a corporation having a minimum paid-up share capital as could also be prescribed, and which by its articles, – (i) restricts the proper to transfer its shares (ii) except just in case of 1 Person Company, limits the amount of its members to two hundred; (iii) prohibits any invitation to the general public to subscribe for any securities.

Characteristics of Private Limited Company

- Members– To begin an organization, a base number of 2 individuals are required and a most extreme number of 200 individuals according to the arrangements of the Companies Act, 2013.

- Limited Liability– The liability of every member or shareholder is restricted. It means if a corporation faces loss under any circumstances then its shareholders are susceptible to sell their own assets for payment. The private, individual assets of the shareholders aren’t in danger.

- Going On– The lifetime of the corporate keeps on existing forever until it winds up.

- A number of directors– When it involves directors a personal company must have only two directors.

- Paid-up capital– Minimum 1 Lakh Paid up Capital requires which can be prescribed from time to time.

- Name– Private Limited Company should add Pvt Ltd in it name.

Advantages of Private Limited Company

- Limited liability: There is a restricted responsibility, which implies the individuals from the organization are not at the danger of losing private resources. Member liable proportionate as their share in company.

- Fewer shareholders: Minimum 2 share Holders required for the private limited company.

- Ownership: This Company owned by Founder, Investor, Member so they are the owner they can sell their share to member of company only. This increase Transparency.

- Existence: Company Exist Forever until Lawfully Closed down.

Disadvantages of Private Limited Company

1-Despite the fact that there are numerous advantages of enrolling a private restricted organization but Compliance as per Law and Winding up is complex.

2-It requires minimum 2 person for setting up/incorporation treated as Director/Shareholder.

*We are your Compliances support so stay faithful we will help to minimize disadvantages. CA ON WEB (CA SERVICE)

Documentation Requirment:-

1.) Documents to be submitted by Directors & Shareholders (Indian Nationals/NRI)

- Self Attested two copy of PAN Card/Passport/Aadhar UID.

- Self Attested two copy of Voter’s ID/Passport/Driver’s License.

- Most recent Bank Explanation/Phone or Versatile Bill/Power or Gas Bill.

- Passport-sized photograph.

- Specimen signature (Director only).

2.) Office Address Proofs

- Copy of Most recent Power or Water Bill.

- Copy Notarised Tenant contract in English.

- Copy most recent Rental Receipt.

- Copy of Offer Deed/Property Deed in English (Owned property)

- Copy of No-complaint Testament from land owner.

Note: Notarised Document (if NRI is currently in India or a Commonwealth country). If not (in a Commonwealth country) notarized by Indian Embassy.

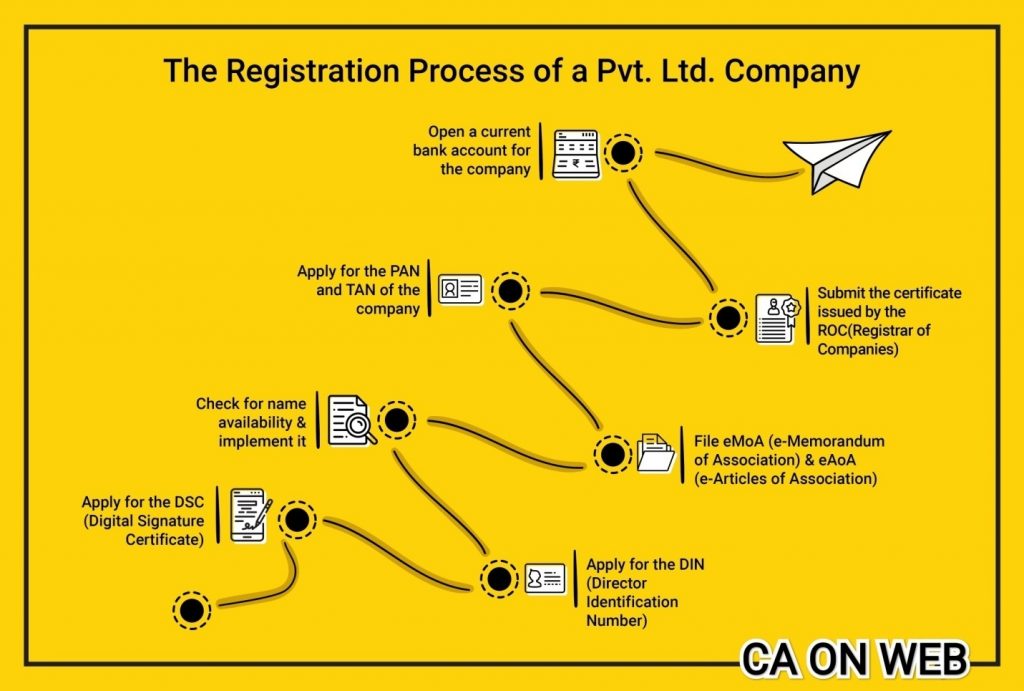

Process Of Registration of PVT Ltd Company:-

Why Choose Us-

We Will Help and Let you know all Related Act and Compliances in User Friendly, Reliable way to facilitate your Startup and a Life Long Commercial Relation.

FAQs:

1.) Who is the proprietor of private restricted organization?

This Company owned by Founder, Investor, Member so they are the owner they can sell their share to member of company only.

2.) Distinction among restricted and private restricted organization?

Ltd company share can traded in stock exchange while in Pvt Ltd in house trading allowed.

3.) Who can start Pvt ltd Company?

Anyone citizen of India even outsider who is of sound mind and approved by Indian Embassy or Indian Govt.

4.) Concern about cost?

No worry Contact https://www.caonweb.com/contact.php we will assist you about charges.

POPULAR ARTICLES

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.