🔊 Play Seamless Exporting Starts Here Owning a business & hoping to expand and sell your products overseas through major online portals like Alibaba and Amazon, exporters in India must ensure they are fully compliant with legal and regulatory requirements. Proper registration, licensing, and adherence to compliance standards are essential steps to establish a credible […]

Category: GST

GST ON YOUR FAVORITE SNACK, Pop Corn

🔊 Play UNPACKED AND UNLABELLED SALTED POPCORN The GST Council’s recent clarification on popcorn taxation has ignited a wave of online memes, with users analysing the complexities of tax rates for various types of popcorn. During its 55th meeting on Saturday, the GST Council clarified the tax structure for popcorn and announced that there would […]

Impact of GST on Export of Goods and Services

🔊 Play GST for export of goods and services in India is zero-rated. Zero-rated supply does not mean that the goods and services have a tax rate of ‘0 ’. It means that the recipient of the supply is entitled to pay ‘0%’ GST to the supplier of goods or services. This blog will help you […]

GST Department is getting stricter day by day!! Are you ready??

🔊 Play Are you aware of the fact that GST department has already put up lenses to check flaws? There are so many businesses who register under GST but they do not file returns. Mostly people are not aware of the fact that even if you are not selling or you have no transactions in […]

Compliances Under GST for a Service Provider

🔊 Play What are GST Returns? Return means a statement of facts filed by taxpayers to tax authorities at regular intervals (monthly, quarterly, yearly, etc.). Similarly, GST returns are nothing but the statement of facts in a statutory format which is to be submitted to tax authorities regarding supplies made, input tax credit claimed and taxes […]

Annual Return under GST (Form GSTR-9)

🔊 Play Form GSTR-9 Every taxpayer registered under Goods & Service Tax is required to file an annual return in the form of GSTR-9. It is required to be filed for every financial year on or before 31st December in the subsequent fiscal year. It is the consolidation of all the returns filed related to […]

Composition scheme under GST

🔊 Play Composition scheme is meant to make the life of small businesses easier. It’s an option wherein a taxpayer can opt to pay a fixed percentage of turnover as fees in lieu of tax and get relief from complying with other provision of law. Below are the important points: Precondition Those having a turnover […]

Know about Reverse charge mechanism under GST Regime

🔊 Play Reverse charge mechanism under GST It is called a reverse charge because under this mechanism, the person at the receiving end, that is the receiver of goods or service is liable to pay GST. CASES WHEN REVERSE CHARGE WILL APPLY The supply made by the unregistered dealer to a registered dealer. Services through […]

Who needs to register under GST in India?

🔊 Play Who needs to register under GST in India? Are you Liable to register under GST? It is mandatory if: Your turnover in a financial year exceeds Rs.20 Lakh( 10 Lakh for NE state) You are dealing with the interstate supply of goods. Interstate supply of services are exempt from service tax registration if […]

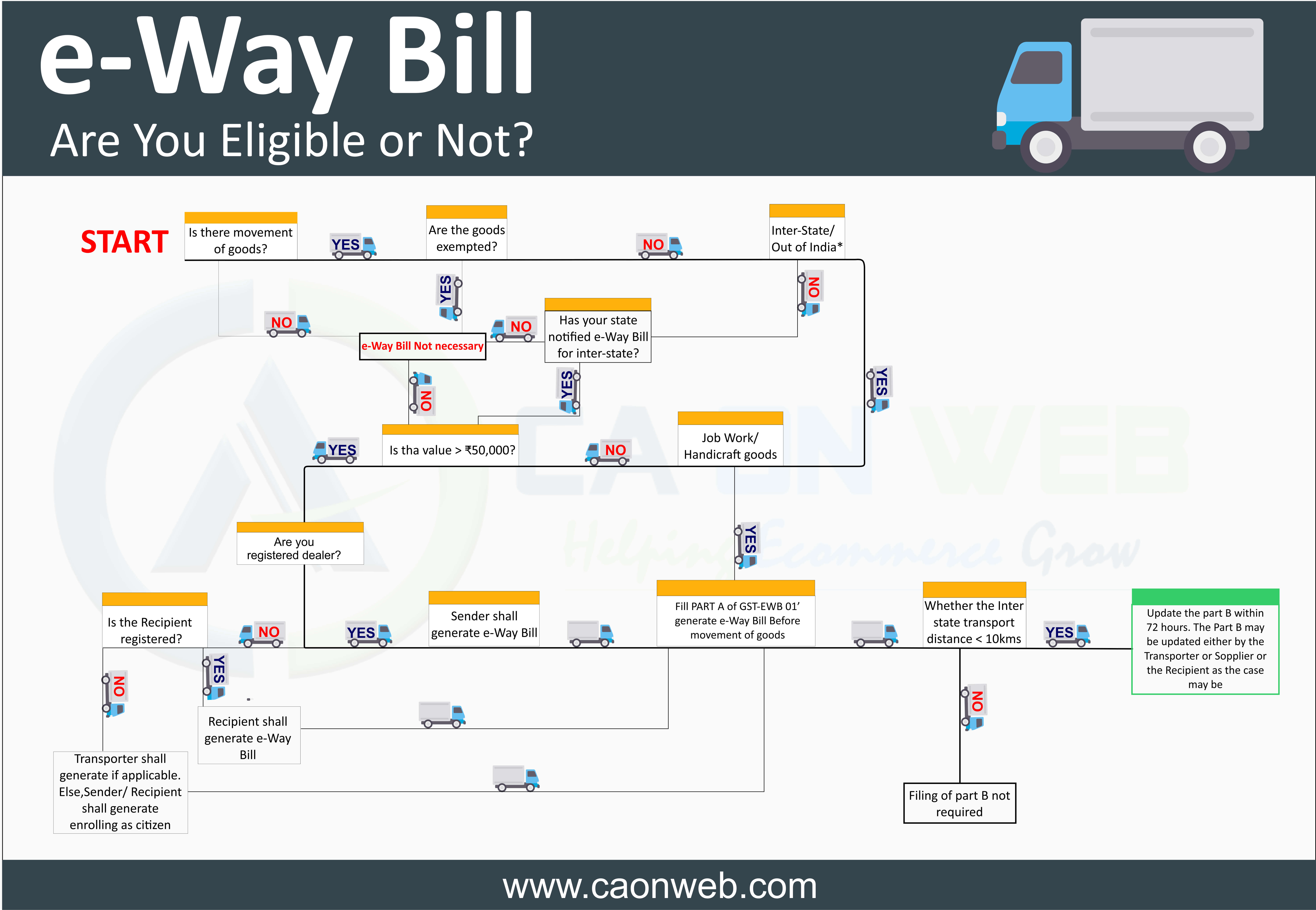

Know all about E-way bill system introduced in GST

🔊 Play An electric waybill is required for movement of goods. For any movement of goods by a registered person for the value of more than Rs.50000 e-way bill is mandatory. The e-way bill can be generated on the Goods and Service Tax portal. This is required for interstate and intrastate both. Generation of the e-way […]