Introduction

Import export code registration or IEC registration is the process of obtaining an authentic license to trade across borders. In India, Directorate general of foreign trade (DGFT), Ministry of commerce & industry is the sole authority for Online Import Export Code Registration. The sole purpose of bringing in IEC code is to effectively regulate & efficiently monitor the foreign trade activities in India.

Since expansion in tune with globalization, are the two main prerogatives for most of the companies in 21st century era, therefore it becomes necessary for them to have a an online Import Export code registration so as to reap the benefits associated with Import & export of goods & services.

📢 Related Blog: WHAT IS AN IMPORT EXPORT CODE (IEC)?

Benefits associated with online Import Export code registration

- Convenience in imports & exports

- Expanding your business operations

- Avail benefits of government schemes & subsidies

- Unlock benefits of international business market places

Process to download Online Import Export code registration certificate

- Visit Online IEC code registration website.

- Enter the details such as:

- PAN number

- Name as mentioned in the PAN card

- Date of Incorporation (As per the PAN)

- Latest file number without slash

- Latest file date

- Enter the OTP [Registered no. or email ID].

- Fill in the CAPTCHA & submit.

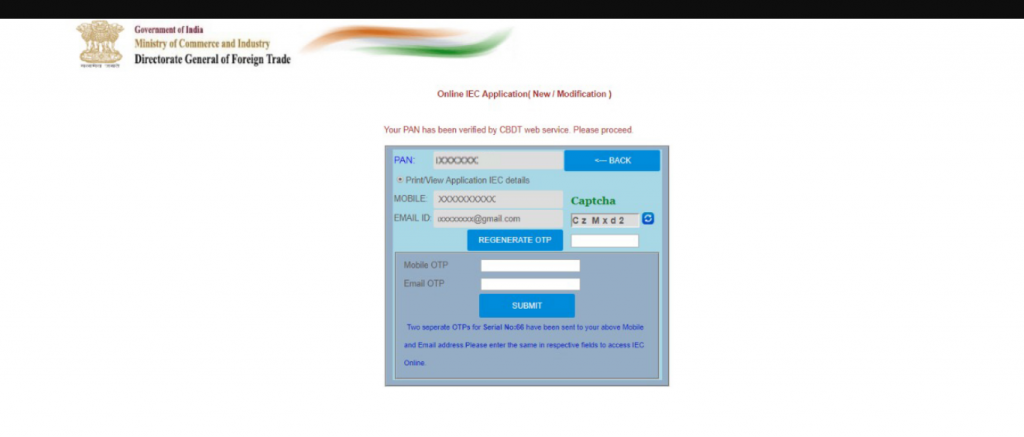

- A new window will be opened where you have to enter your PAN card number, as per the PAN card number the Email Id and the Contact number will be auto-populated. (Registered Email Id and mobile number).

- Mention the OTP details and submit.

📢 Register your Company 3999₹

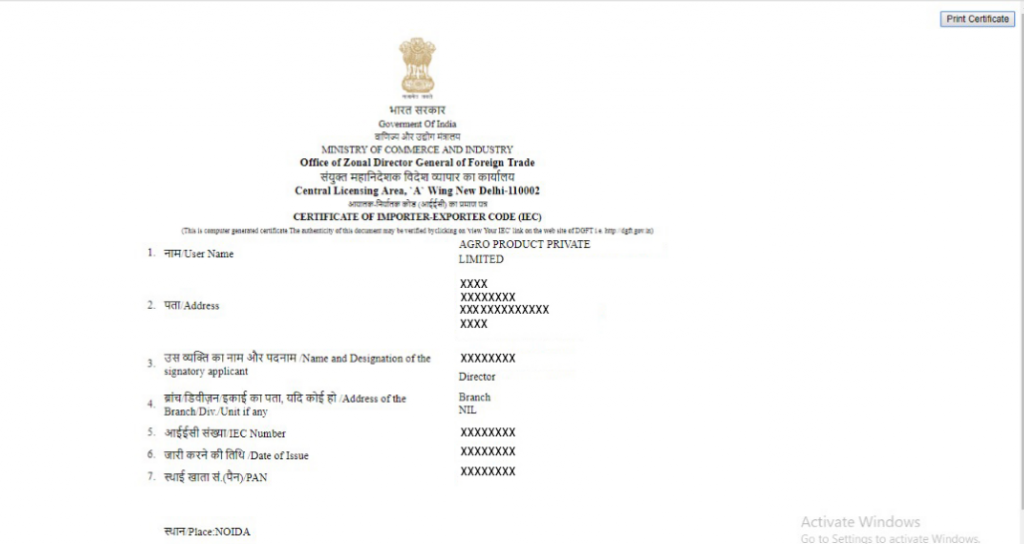

- Take the print of your IEC certificate.

FREQUENTLY ASKED QUESITONS (FAQ’s)

Q.) Is there any tax imposed based on Import Export registration Code?

No, Import export code is a form of licensing certificate which is required to facilitate cross border trade. IEC in itself is not a tax rather it can initiate a tax on your trade. For example: – Customs duty.

Q.) Can individuals apply for IEC?

Yes, Individuals can apply for online Import export registration code, either in the name of company or personal name. Having an IEC will facilitate their international trade.

Q.) Is it necessary to provide PAN Card for IEC?

Yes, providing a self-attested copy of your PAN Card is mandatory to complete the process of Import export code registration.

Q.) Is there any method of import-export without getting a license?

No, import export trade could not take place without furnishing an active Import export license.

Q.) What is IEC registration?

Online Import export registration is a certificate of authorization which is issued to an individual/organization by the DGFT, Government of India to facilitate trade.

For example: If any business entity looking to export his products to Spain & accept a shipment from there for the purpose of reselling, then you must have IEC registration certificate to make it a smooth process.

What are the documents required for IEC code?

- Photograph of the applicant

- Copy PAN Card.

- Bank certificate

📢 Related Blog: HOW TO APPLY FOR IEC ONLINE REGISTRATION [IMPORT-EXPORT CODE]

Find the complete list of documents required for IEC registration in India with the help of mentioned link (https://dgft.gov.in/sites/default/files/app2_0.pdf)

Chartered Accountant by profession, CA Sakshi Agarwal has an experience of above11 years in Cross Border compliance , Import Export , International Taxation & is a passionate content creator.