🔊 Play By Expert CA Sakshi Agarwal In today’s globalized business landscape, navigating the legal requirements of foreign investments and share transfers can be a daunting task. For businesses expanding their footprint internationally, understanding the nuances of Form FC GPR (Foreign Currency General Permission) and FC TRS (Transfer of Shares) is crucial. In this comprehensive […]

SIMPLIFYING THE PROCESS OF BUSINESS SETUP IN DUBAI

🔊 Play Dubai, with its dynamic economy and strategic location, has emerged as a global business hub attracting entrepreneurs from all corners of the world. The process of setting up a business in Dubai might seem complex at first glance, but with expert guidance from CA on Web Pvt. Ltd. it can be a smooth […]

How to Register a Foreign Subsidiary in India

🔊 Play IntroductionIndia is one of the world’s fastest-growing economies and a profitable market for foreign companies. Setting up a subsidiary in India could be a feasible approach for foreign companies to expand their operations and gain exposure to this large customer base. In this blog, We CA on Web Pvt. Ltd. will provide a comprehensive guide […]

LIBERALISED REMITTANCE SCHEME (LRS)

🔊 Play The Liberalized Remittance Scheme (LRS) is part of the Foreign Exchange Management Act (FEMA) 1999, laying down the guidelines for outward remittance from India. Under LRS, all resident individuals, including minors, are allowed to freely remit up to USD250,000 per financial year (April – March). 1. Who is eligible to remit funds outside India […]

USA EIN: Employer Identification Number

🔊 Play (a) What is EIN : An Employer Identification Number (EIN) is a nine-digit social security number (SSN) for your company also known as a Federal Tax Identification Number issued by the IRS used to identify a business entity. Generally, businesses need an EIN.After forming a USA corporation or LLC (limited liability company), the […]

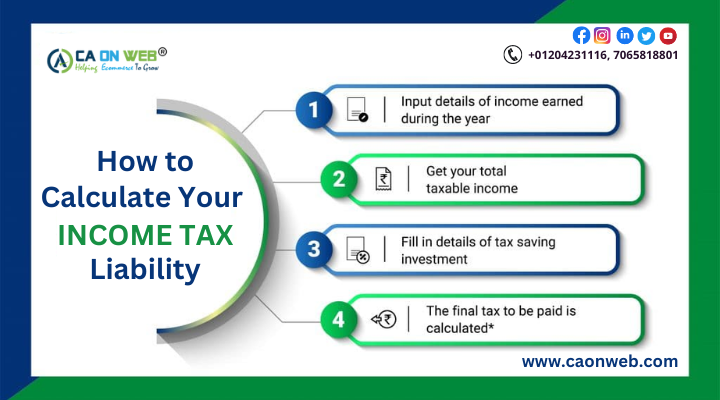

How to Calculate Your Income Tax Liability

🔊 Play In this blog, you will learn to calculate taxable income with Caonweb. Your overall tax obligation to the government is known as your income tax liability. The sum of income tax, surcharge, health and education cess is used to calculate it. Overview of Tax liability Tax liabilities are the sums of money that […]

The Pros and Cons of Starting an OPC in India

🔊 Play The process of creating a Private Limited Company & One Person Company is the same. The Companies Act,2013 approval led to the creation of this kind of business. This type of business has gained popularity since it enables anyone to start a company without having to consider shareholders or subscribers. One-person company in India has […]

IMPORT EXPORT CODE IN IN INIDA

🔊 Play Caonweb can help you with registration by giving you an application for an Import Export Code. They are offering the best Tax consultant near me services. What is meant by Import Export license/Registration? To import or export goods or services, an individual or business needs the 10-digit Import Export Code (IEC). The Director […]

TAX PREPARATION SERVICES IN INDIA

🔊 Play Tax preparation services involve the professional preparation of tax returns for individuals or corporations. Package Inclusions : GST computations and returns are among the services we offer. Tax preparation for individuals, partnerships, and corporations. Filings for businesses, individuals, and GST/HST Value-added tax and income tax computation and filing. Overview of Tax planning & […]

How to Register a Company in India in 2023 – CAonWeb

🔊 Play Do you wish to do company incorporation in India? We are confident that this article will provide all the information on how to register a company and are looking for details on the company registration process. What is a company? : how to register a company registration A company can be broadly characterized as a business entity established by […]