🔊 Play Audit of a new company is mandatory irrespective of its volume or turnover. If you are into a business then it is essential to know your compliance requirement. Apart from handling your daily operations, it is important to know what are the regulatory authorities to whom you need to submit certain information or […]

Composition scheme under GST

🔊 Play Composition scheme is meant to make the life of small businesses easier. It’s an option wherein a taxpayer can opt to pay a fixed percentage of turnover as fees in lieu of tax and get relief from complying with other provision of law. Below are the important points: Precondition Those having a turnover […]

Know about Reverse charge mechanism under GST Regime

🔊 Play Reverse charge mechanism under GST It is called a reverse charge because under this mechanism, the person at the receiving end, that is the receiver of goods or service is liable to pay GST. CASES WHEN REVERSE CHARGE WILL APPLY The supply made by the unregistered dealer to a registered dealer. Services through […]

Who needs to register under GST in India?

🔊 Play Who needs to register under GST in India? Are you Liable to register under GST? It is mandatory if: Your turnover in a financial year exceeds Rs.20 Lakh( 10 Lakh for NE state) You are dealing with the interstate supply of goods. Interstate supply of services are exempt from service tax registration if […]

Compliance to be followed by company in India in 2018

🔊 Play Compliance to be followed by the company in India in 2018 If you have incorporated a private limited company, you must read this as we speak about the mandatory compliance to be followed by you in the year 2018, You may be a startup or an existing business in India understanding all the […]

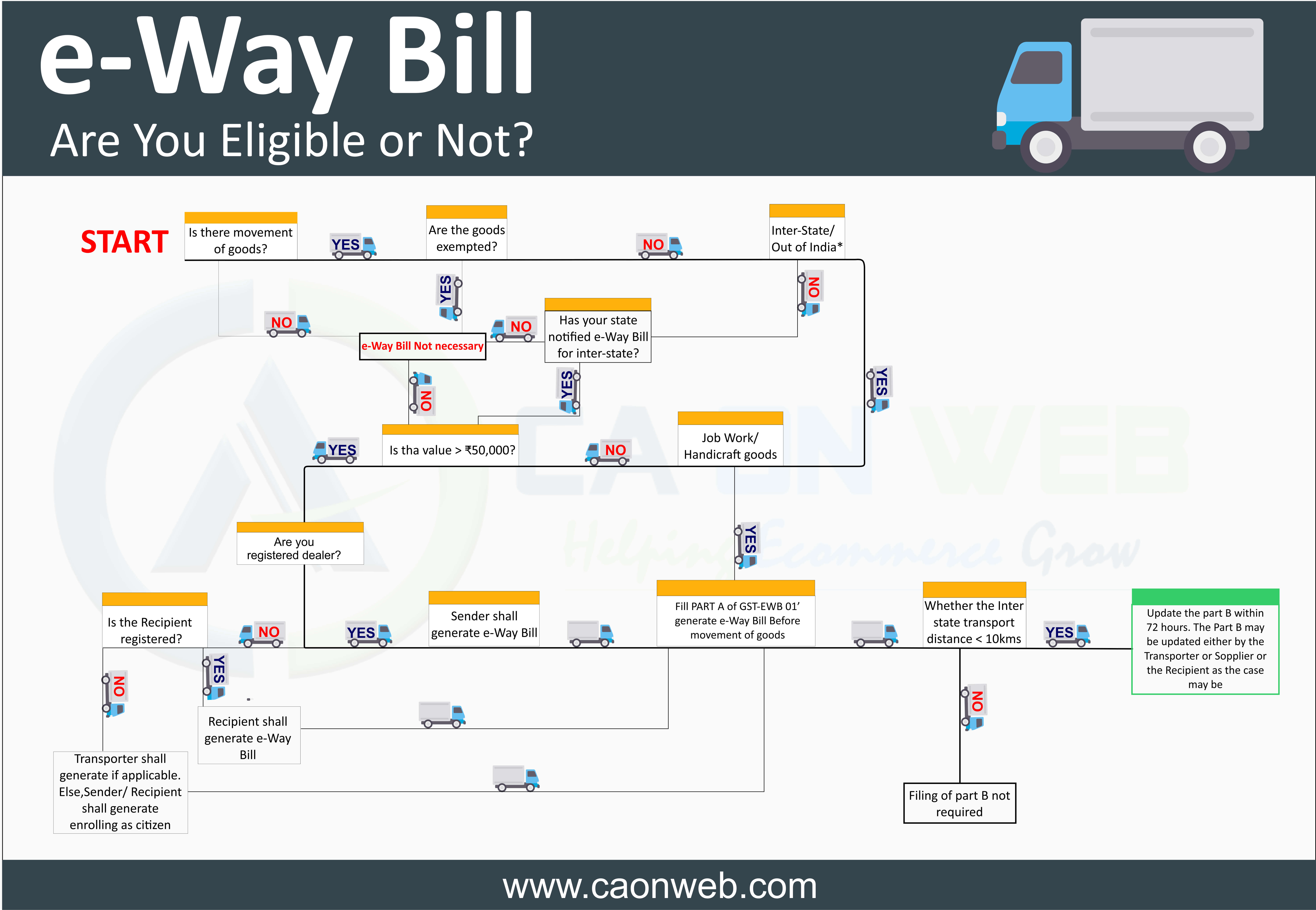

Know all about E-way bill system introduced in GST

🔊 Play An electric waybill is required for movement of goods. For any movement of goods by a registered person for the value of more than Rs.50000 e-way bill is mandatory. The e-way bill can be generated on the Goods and Service Tax portal. This is required for interstate and intrastate both. Generation of the e-way […]

Best Platform for All the Accounts Tax Professionals Around The World

🔊 Play CAONWEB, best platform for all the accounts/Tax professionals around the world, Read how: You are taxation or accounts service provider, You may be a CPA, a Chartered Accountant, A Public Accountant- You work is related to bookkeeping, tax computing, return filing, certification, legal entity incorporation- then caonweb.com is the best platform for you. […]

How can a Non Resident or a foreigner establish company in India?

🔊 Play Foreign investment in India is a major monetary source for economic development in India. Apart from being a major source of economic growth, foreign investment in India is a major source of non-debt financial resource for the economic development of India. Foreign investment in India is made by foreign companies so that they can take advantage of […]

A Brief explanation about Integrated Goods and Service Tax

🔊 Play IGST is a part of Goods and Service Tax (GST) IGST means Integrated Goods and Service Tax, one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax one nation. IGST falls under Integrated Goods and Service Tax Act 2016. IGST is charged when […]

A Brief simple explanation about State Goods and Service Tax (SGST)

🔊 Play SGST is a part of Goods and Service Tax (GST). SGST means State Goods and Service Tax, one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax one nation. SGST falls under State Goods and Service Tax Act 2016. For easy understanding, when […]