🔊 Play Compliance to be followed by the company in India in 2018 If you have incorporated a private limited company, you must read this as we speak about the mandatory compliance to be followed by you in the year 2018, You may be a startup or an existing business in India understanding all the […]

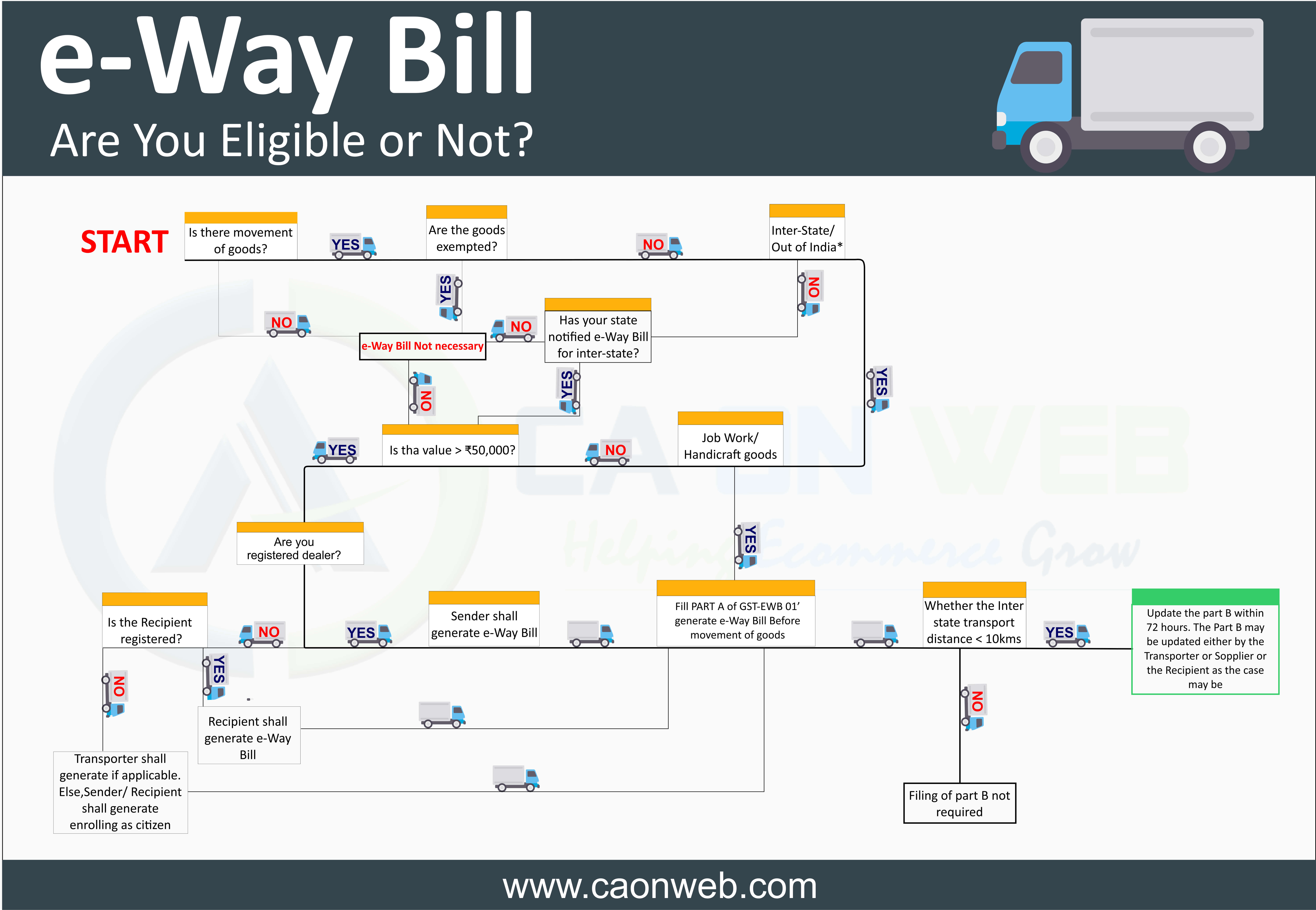

Know all about E-way bill system introduced in GST

🔊 Play An electric waybill is required for movement of goods. For any movement of goods by a registered person for the value of more than Rs.50000 e-way bill is mandatory. The e-way bill can be generated on the Goods and Service Tax portal. This is required for interstate and intrastate both. Generation of the e-way […]

Best Platform for All the Accounts Tax Professionals Around The World

🔊 Play CAONWEB, best platform for all the accounts/Tax professionals around the world, Read how: You are taxation or accounts service provider, You may be a CPA, a Chartered Accountant, A Public Accountant- You work is related to bookkeeping, tax computing, return filing, certification, legal entity incorporation- then caonweb.com is the best platform for you. […]

How can a Non Resident or a foreigner establish company in India?

🔊 Play Foreign investment in India is a major monetary source for economic development in India. Apart from being a major source of economic growth, foreign investment in India is a major source of non-debt financial resource for the economic development of India. Foreign investment in India is made by foreign companies so that they can take advantage of […]

A Brief explanation about Integrated Goods and Service Tax

🔊 Play IGST is a part of Goods and Service Tax (GST) IGST means Integrated Goods and Service Tax, one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax one nation. IGST falls under Integrated Goods and Service Tax Act 2016. IGST is charged when […]

A Brief simple explanation about State Goods and Service Tax (SGST)

🔊 Play SGST is a part of Goods and Service Tax (GST). SGST means State Goods and Service Tax, one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax one nation. SGST falls under State Goods and Service Tax Act 2016. For easy understanding, when […]

A Brief explanation about Central Goods and Service Tax

🔊 Play CGST is a part of Goods and Service Tax (GST) CGST means Central Goods and Service Tax, one of the three categories under Goods and Service Tax (CGST, IGST, and SGST) with a concept of one tax one nation. CGST falls under Central Goods and Service Tax Act 2016. For easy understanding, when […]

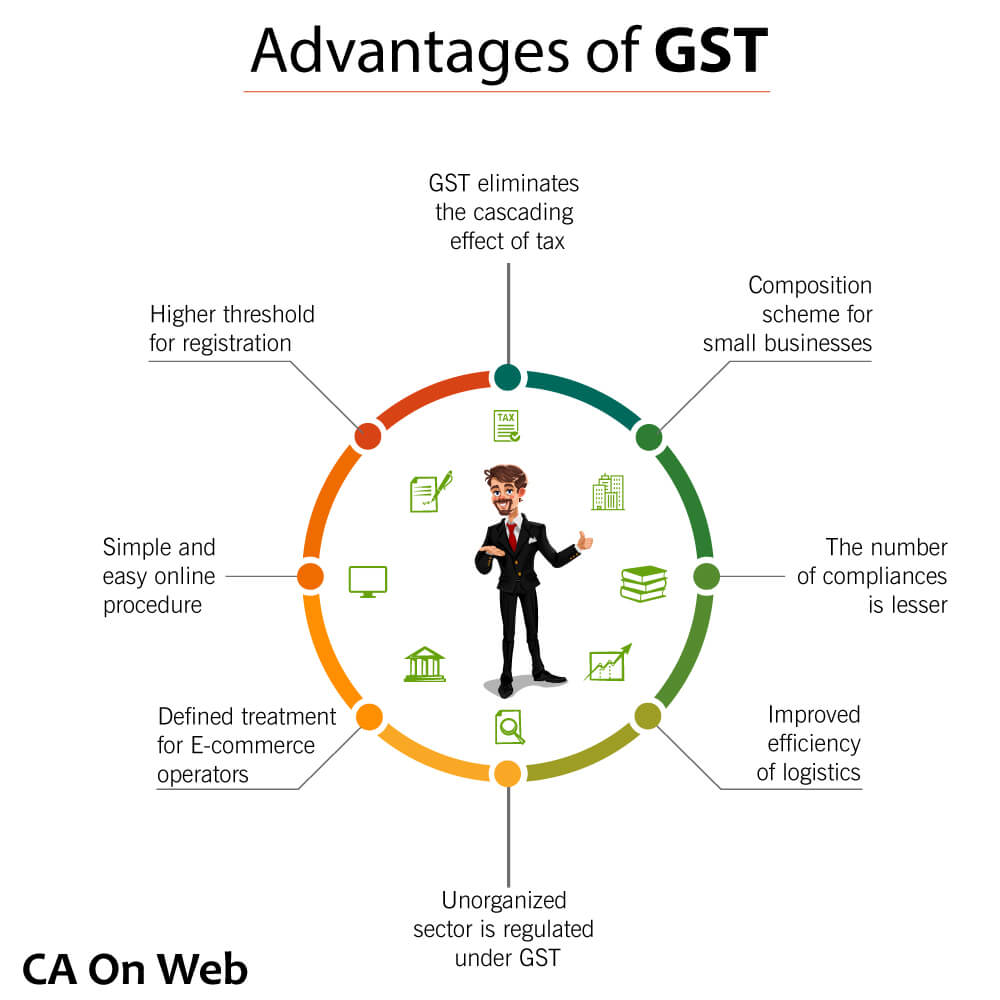

Advantages of GST

🔊 Play GST Eliminates the Cascading Effect of Tax GST is a comprehensive indirect tax that was designed to bring the indirect taxation under one umbrella. More importantly, it is going to eliminate the cascading effect of tax that was evident earlier. Cascading tax effect can be best described as ‘Tax on Tax’. Let us take […]

Want To Export Honey, Jaggery And Sugar Products From India? You Need APEDA Registration

🔊 Play For any exporter who is exporting scheduled products from India, Needs to have APEDA Registration. APEDA means Agriculture and processed food products export development authority. The main motive is to promote the export of scheduled products from India. Agriculture is a major source of livelihood, India has a huge potential in terms of various […]

Income Tax Return Filing In India

🔊 Play “Income tax return filing procedure is a system through which one discloses income, deduct tax, pay taxes or claim the refund. The system of submitting the report of income, tax paid, tax deduction, refund to be claimed is known as income tax return filing procedure. In the process of income tax return filing in […]