🔊 Play How a private limited company registration is suitable for Startups in India? Startups require a different and unique business environment to function and India exactly possesses the same. Capital flexibility, no. of directors, fund raising for business and easy procedures to hold business meetings and carrying AGM’s are some of the benefits being […]

RULES & REGULATIONS OF ARBITRATION PROCEEDINGS IN INDIA

🔊 Play WHAT IS ARBITRATION? In simple terms, Arbitration is an informal form of the judiciary that helps in resolving the dispute between two or more than two parties. Arbitration is a legal procedure in which both parties refer their dispute to one or more arbitrators which implies a binding decision on both parties. Arbitration proceedings in […]

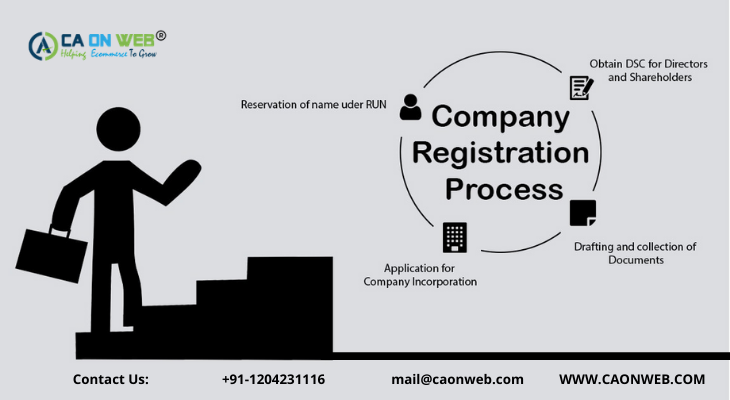

SIMPLE STEPS OF COMPANY REGISTRATION IN INDIA

🔊 Play A complete beginner’s level guide for Startup India registration We all have a creative & unique business idea with us; and we all have a big shot dream of staring our own venture. But what is pulling all of us back is lack of adequate knowledge and direction needed to go for Startup […]

MSME REGISTRATION | ONLINE PROCESS, ELIGIBILITY & BENEFITS

🔊 Play Micro, Small & Medium Enterprise Registration holds a much crucial position in the business sector of India. MSME sector is under the topmost priority segment of the government and they are bringing in favorable laws to boost this sector. To give you more insights about the MSME registration process and benefits attached with it, we would […]

PROCEDURE OF APEDA REGISTRATION FOR EXPORT OF AGRICULTURAL GOODS

🔊 Play Simplified way of getting APEDA registration in India APEDA license registration (Agricultural & processed food products export development authority) is required by every individual planning to export agricultural & schedule products. APEDA registration is governed directly by the government of India via. Ministry of commerce & Industry viz. is considered as the apex […]

STARTING A BUSINESS IN INDIA

🔊 Play New simple step by step process for Startup India registration “Start small to go big”. Almost all businesses go through this stage. Initially every business starts from small level & eventually goes big. There are no limits & restrictions for starting a business in India; all you need is proper business idea that […]

VIRTUAL CFO SERVICES IN INDIA

🔊 Play The chief financial officer is the most essential part of every organization since he/she is the primarily responsible for all the long term or short term financial decision of the company. Along the same lines, a virtual CFO is the widely looked for, by the Startups, entrepreneurs, new business houses etc. at a […]

Difference between Auditor & Compliance Officer

🔊 Play The distinction between the auditor and the compliance officer is not always apparent. There are obvious parallels, and the two have common characteristics with some overlap, so it is fair to confuse them with almost fusion. In certain instances, they must function together, but there are distinct variations. One interesting difference is that […]

CHARTERED ACCOUNTANT CERTIFICATE FOR VISA

🔊 Play CA certificate for visa is also known as net worth certificate. Net worth is the aggregate resources of an individual or an enterprise by deducting liabilities from total asset size. So to process the visa effectively in minimum time frame, one requires CA certificate to authorize the net worth. The prime objective of […]

HOW TO GET APEDA LICENSE REGISTRATION IN INDIA

🔊 Play Agriculture & processed food products export development authority (APEDA) is government regulated body which is operating under the Ministry of commerce & industry. APEDA act came into force in 1986 through Agriculture & processed food product export development authority act, 1985 which was passed by the parliament. With the help of APEDA registration […]